ctcLink State Reimbursement Processes

ctcLink State Reimbursement Processes

Revised 2024-03-30

Payroll

Upon completion of payroll processes, ctcLink Payroll support staff notify colleges by email that checks are ready to run.

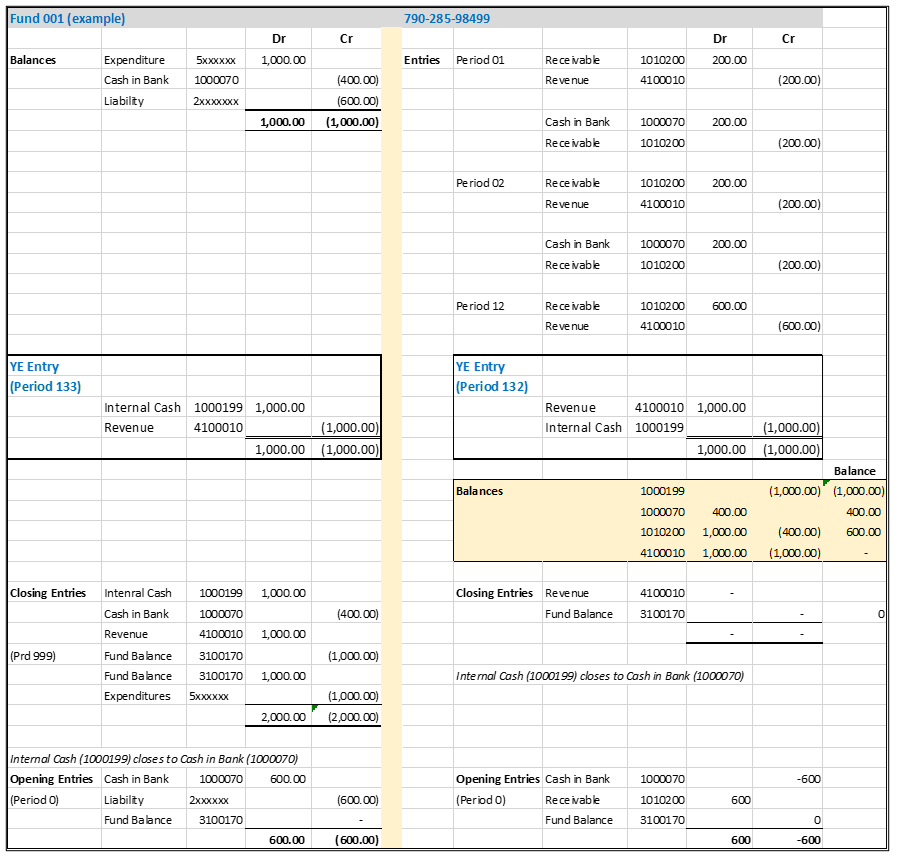

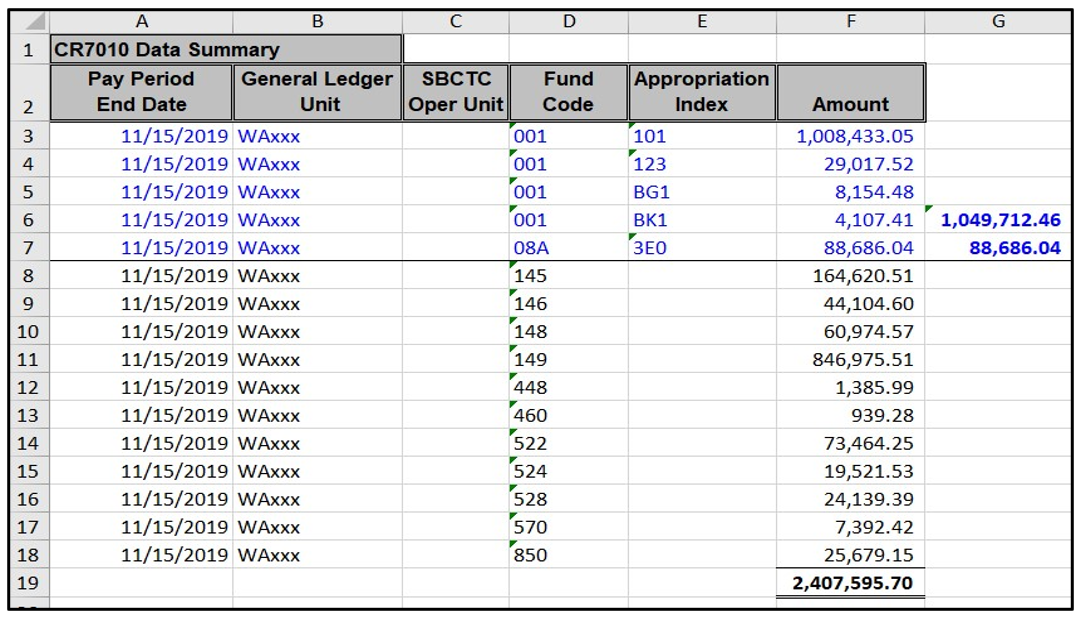

Each college must run the CR7010 query or report (QHC_PY_CR7010_SUMMARY_BY_FUND).

Fig. 1 Query Viewer screen

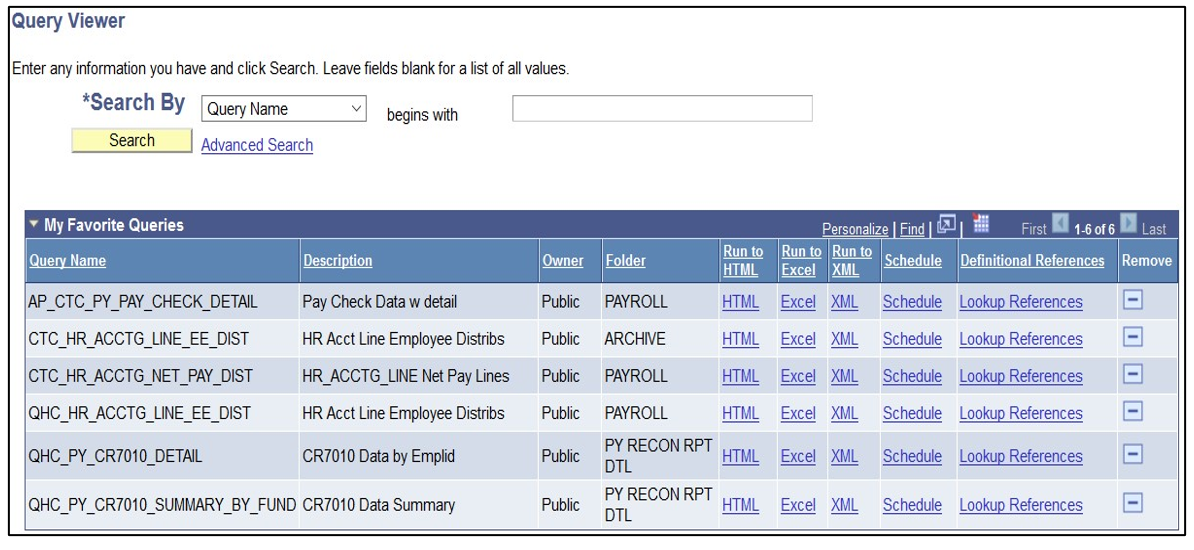

Find an Existing Value (if you have run query previously) or Add a New Value.

Fig. 2 Scheduled Query Screen

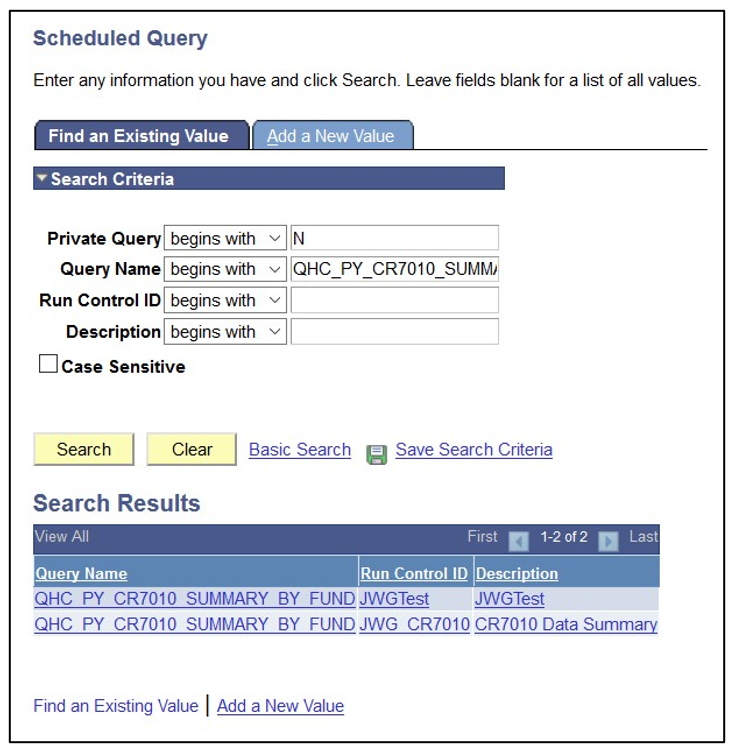

For a single payroll the values for PAY_END_DT are the same.

Fig. 3 Schedule Query

Fig. 4 Data Summary Screen

For the 06B payroll, you should record the receivable/revenue before the submodule closes.

If you miss the deadline, you will be required to follow the normal procedures for year-end accruals.

- Customer 001000762

- Bill Type Identifier: VPA

- Distribution Code (AR Offset): Due from VPA (see f.) below)

- Revenue Distribution (see f) below)

- Fund 790/Class 285/98499

- Debit 1010xxx/Credit 4x000xx

- 4100010 – State General Fund 001

- 4100020 – State Education Legacy Trust Fund 08A

- 4100030 – Employment Training Fund 11A (State Board Only)

- 4100065 - Invest in WA Account 20F

- 4100060 – Pension Stabilization Fund 489

- 4100070 - Workforce Invest Fund 24J (account corrected)

- 4100075 - Climate Control 26O

- 4200010 – St Bldg Cap Project Fund 057

- 4200020 – CC Capital Project Fund 060

- 4200030 – Gardner Evans Higher Education Construction Fund 357

- 4100040 – Education Const Fund 253

- 4200040 – Model Toxics Capital Project Fund 23N

- 4200050 – Climate Commitment Capital Project Fund 26C

- 4200060 – Community Assistance Capital Project Fund 26 V (Bellevue ONLY)

Record receipt of payment (deposit) by Treasurer (10000x0/1010xxx).

For the 06B payroll, this transaction should occur in the next fiscal year – following the normal rules for cash, cash must be recorded in the fiscal year in which it is received.

Reconcile cash in bank (10000x0/10000x0).

IMPORTANT: Do NOT invoice the Treasurer for this bill!

Monthly Expenditures (Non-Payroll)

After month-end close for Accounting Periods 1-132

Run query to identify net non-payroll expenditures by AFRS Fund/PS Fund (AI)/Project ID/Project User Field 5/Account for all capital projects

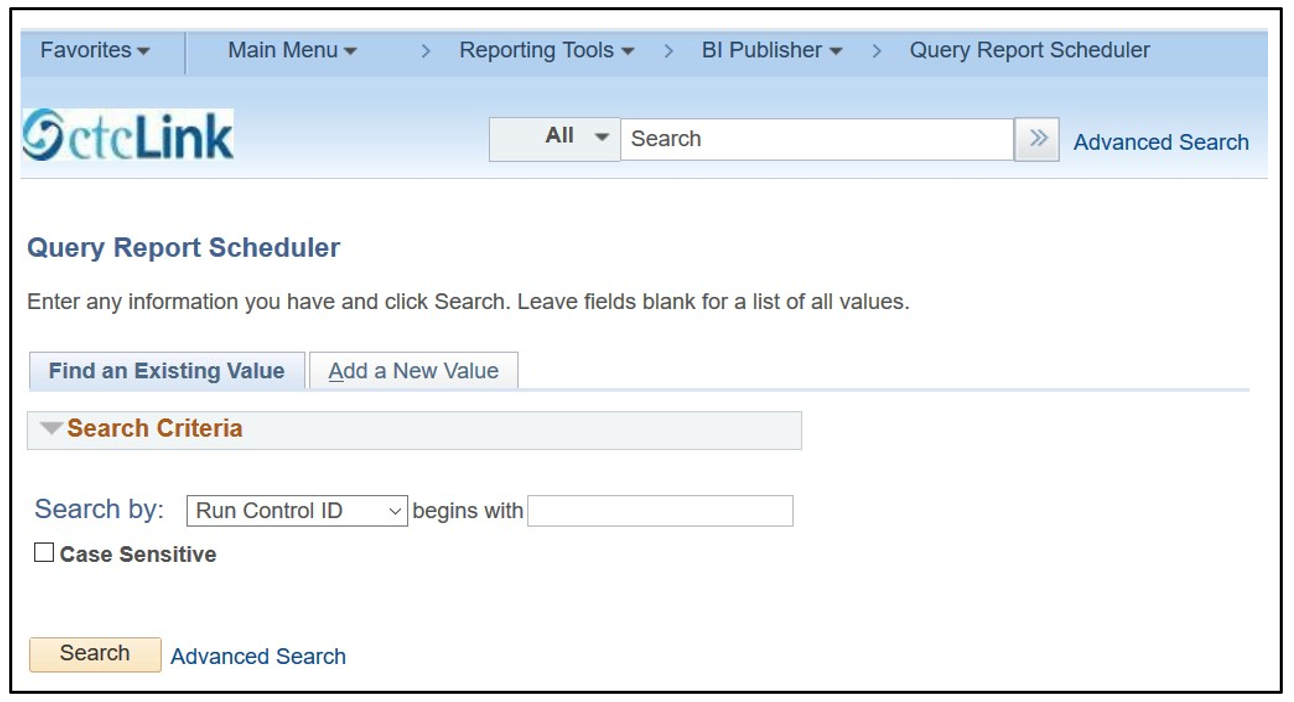

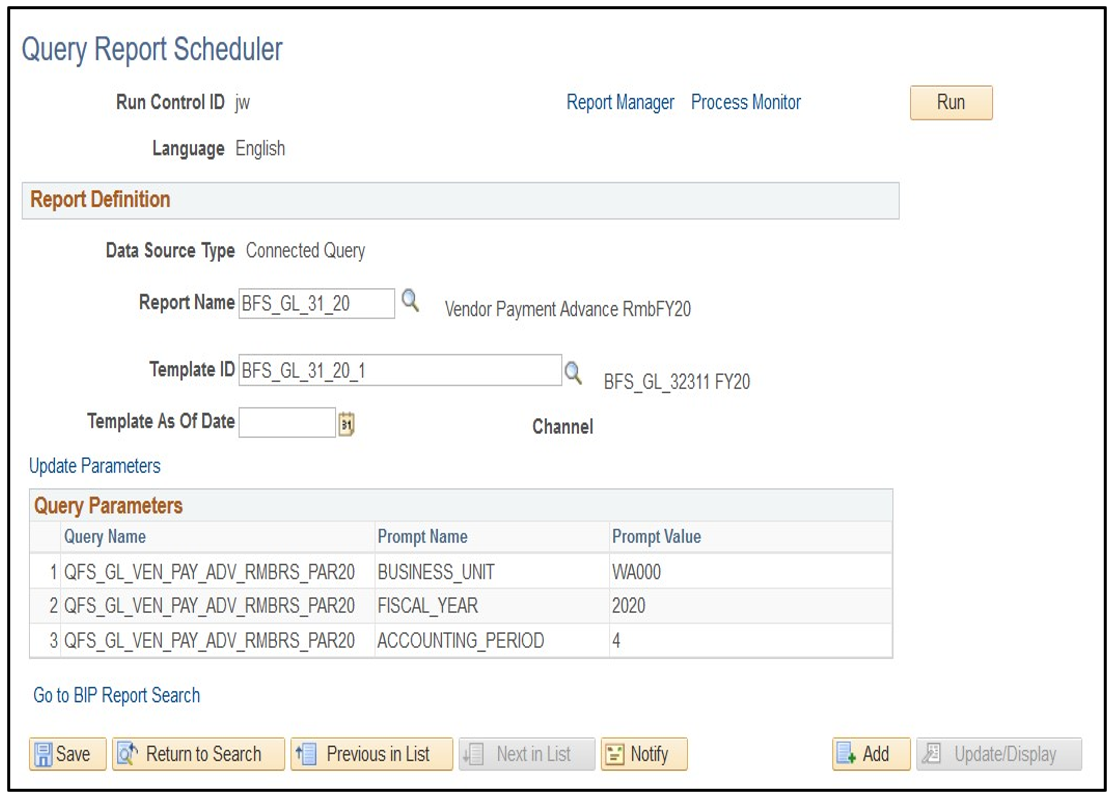

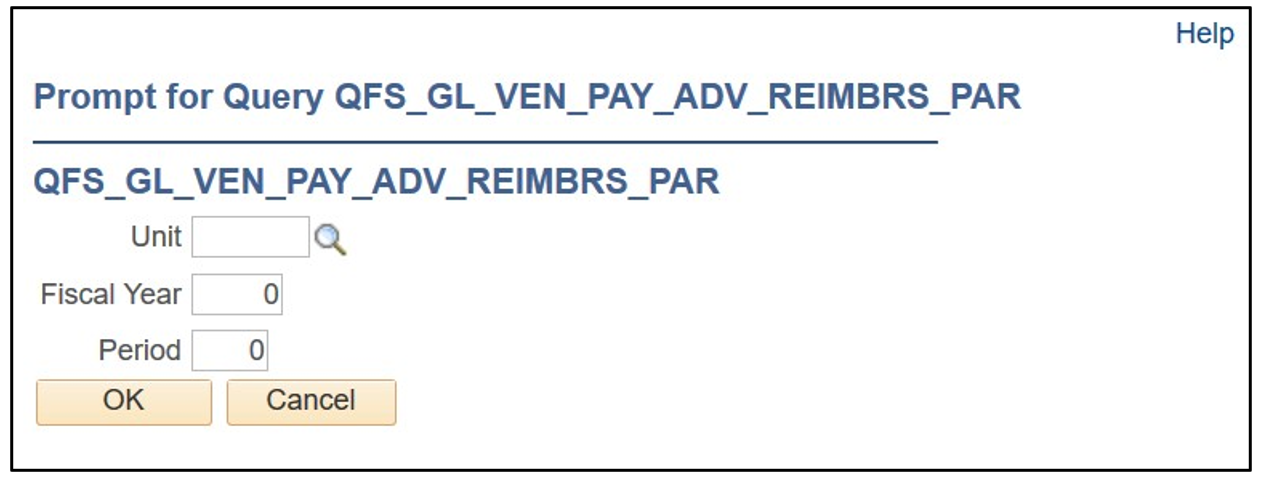

Fig. 5 Query Report Scheduler

Fig. 6 Update Parameters for current month in Query Report Scheduler

Fig. 7 Enter Business Unit (WAnnn), Fiscal Year (nnnn), Period (nn)

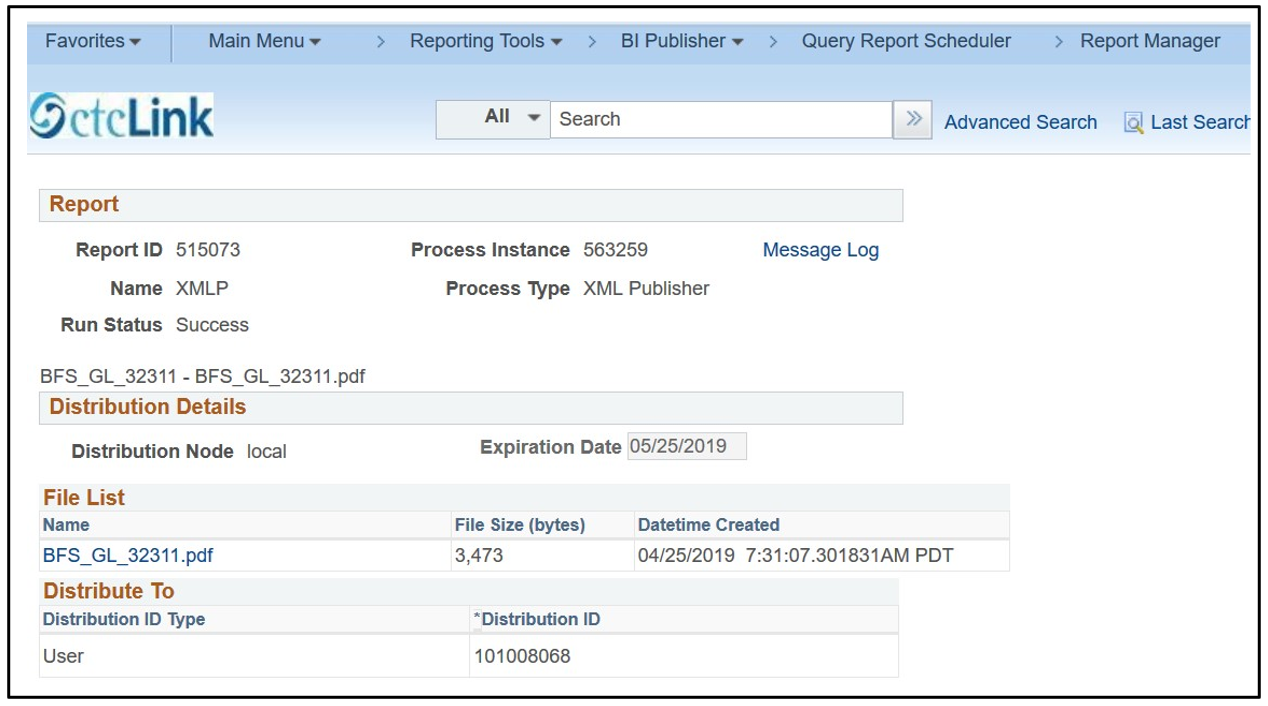

Fig. 8 Open Report Manager

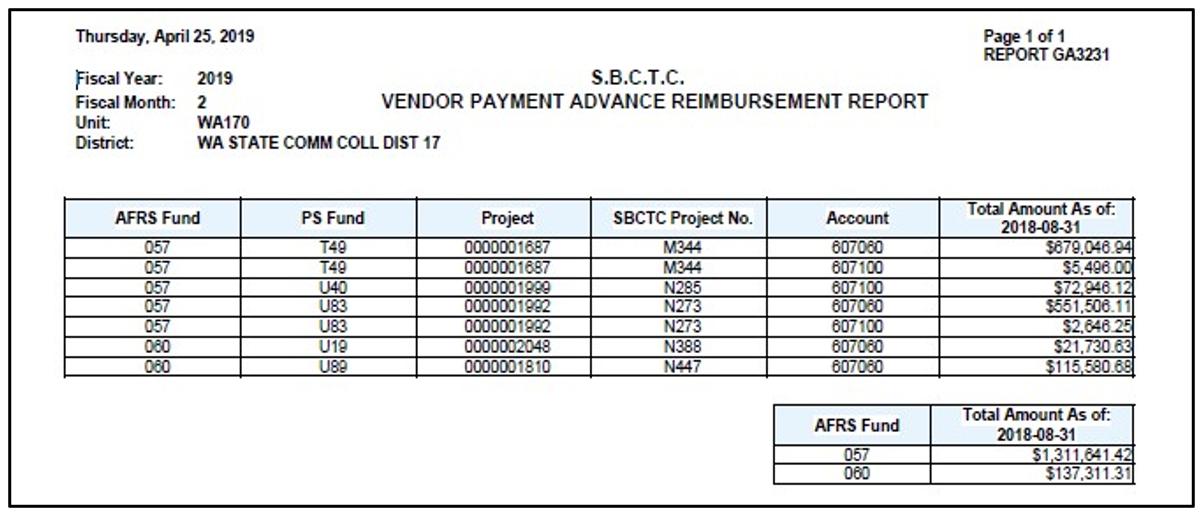

Fig. 9 View VPA report

Do NOT record as A/R Open Item or as Direct Journal.

For Periods 13-132 please follow the instructions for year-end accruals.

- Customer 001000762

- Bill Type Identifier: VPA

- Distribution Code (AR Offset): Due From VPA (see f) below)

- Revenue Distribution (see f) below)

- Create a One Time Express Billing

- Fund 790/Class 285/98499

- Debit 1010200/Credit 4x000xx

- 4100010 – State General Fund 001

- 4100020 – State Education Legacy Trust Fund 08A

- 4100030 – Employment Training Fund 11A (State Board Only)

- 4100065 - Invest in WA Account 20F

- 4100075 - Climate Control 26O

- 4100060 – Pension Stabilization Fund 489

- 4100070 - Workforce Invest Fund 24J (account corrected)

- 4200010 – St Bldg Cap Project Fund 057

- 4200020 – CC Capital Project Fund 060

- 4200030 – Gardner Evans Higher Education Construction Fund 357

- 4100040 – Education Const Fund 253

- 4200040 – Model Toxics Capital Project Fund 23N

- 4200050 – Climate Commitment Capital Project Fund 26C

- 4200060 – Community Assistance Capital Project Fund 26V (Bellevue ONLY)

This step is completed by SBCTC for the colleges. SBCTC submits A7 Treasury Journals to the State Treasurer.

Record receipt of payment (deposit) by Treasurer (10000x0/1010xxx).

Reconcile cash in bank (10000x0/10000x0)

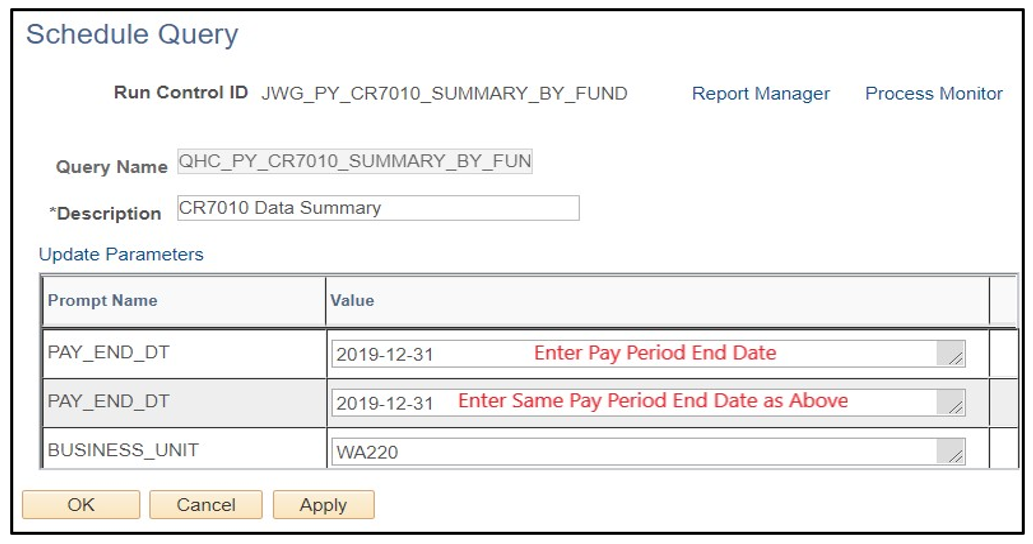

Year-End Entries (Prd 132 and 133)

Reverse (Dr) all revenue (4100010, 4200010, etc.) in 790-285-98499 with an offset (Cr) to Internal Cash 1000199.

Record Internal Cash (Dr 1000199) and revenue (Cr 4x000xx).

Record Internal Cash (Dr 1000199) and Revenue (Cr 4x000xx) in each Appropriation Index (101, 3E0, etc.) ensuring the revenue equals the cash expenditures.

Fig. 10 Typical Year-End Ledger Entries