ctcLink Accounting Manual | 40.60.40 Subscription-Based IT Arrangements (SBITA)

40.60.40.1 SBITA Overview

Subscription-Based IT Arrangements (SBITAs) are contracts that convey control of the right to use another party’s (SBITA vendor) IT software, alone or in combination with tangible capital assets, as specified in the contract for a period of time in an exchange for exchange-like transaction.

Any SBITA with a maximum possible subscription term of 12 months or less cannot be capitalized. Record these payments as a current period expenditure/expense.

The subscription term is the period during which the agency has a non-cancelable right to use an underlying IT asset, including any periods covered by:

- The option to extend the subscription if it is reasonably certain that option will be exercised.

- The options to terminate the subscription if it is reasonably certain that option will not be exercised.

Period for which both the agency and the vendor have an option to terminate the contract without permission from the other party (or if both parties must agree to extend) are cancelable periods and are excluded from the subscription term, regardless of whether it is reasonably certain that option will be exercised. For example, if the contract contains a clause that allows both the agency and the vendor to cancel with 60 days’ notice, the maximum subscription term is 60 days, and the contract should be accounted for as a short-term SBITA.

Fiscal funding or cancellation clauses should be ignored. These clauses allow agencies to cancel a contract, typically on an annual basis, if the government does not appropriate funds for the payments.

Colleges must record all SBITAs that exceed the state’s capitalization threshold ($1,000,000 in total SBITA payments over the agreement term) in DebtBook.

Colleges may record SBITAs that do not meet the state’s threshold to assist with determining and calculating the college’s threshold and adjusting entries for financial statement purposes.

SBITAs that meet the state’s capitalization policy must be recorded as an acquisition of a capital asset and the incurrence of a liability.

SBITAs that do not meet the capitalization threshold should be recognized as a current period expenditure/expense by the lessee and/or revenue by the lessor.

40.60.40.2 Valuing the SBITA

At the commencement of the subscription term, the subscription liability should be recorded at the present value of payments expected to be made during the subscription term including the following:

- Fixed payments

- Variable payments that depend on an index or a rate (such as the Consumer Price Index or a market rate), measured using the index or rate as of the commencement of the subscription term

- Variable payments that are fixed in substance

- Payments for termination penalties if it is reasonably certain that option will be exercised

- Any subscription contract incentives receivable from the vendor

- Any other payments that are reasonably certain of being required

- Implementation Costs

The future subscription payments should be discounted using the interest rate the vendor charges the agency. If the rate is not readily determinable, the state’s incremental borrowing rate should be used, that is the interest rate the state would be charged to finance a similar asset.

Variable payments based on future performance of the agency or usage of the underlying IT assets, such as charges based on number of users, should not be included in the measurement of the subscription liability. Rather, those variable payments should be recognized as an expenditure/expense in the period in which the obligation for those payments is incurred.

The intangible subscription asset should be recorded as the sum of the subscription liability, any payments made to the vendor at or before the commencement of the subscription term, and any capitalizable initial implementation costs, less any agreement incentives received from the vendor at or before the commencement of the subscription term.

Implementation costs are capitalized upon the occurrence of all of the following criteria, costs incurred prior to meeting these criteria are not capitalized:

- Determination of the specific objective of the project and the nature of the service capacity that is expected to be provided by the intangible asset upon the completion of the project.

- Demonstration of the technical or technological feasibility for completing the project so that the intangible asset will provide its expected service capacity. For example, technical feasibility can be demonstrated by the selection of a commercially available software package or by the selection of a development path to meet service capacity requirements.

- Demonstration of the current intention, ability, and presence of effort to enter into a SBITA contract.

Specifically with respect to implementing SBITAs, there are three stages involved:

- Preliminary project stage, which includes conceptual formulation and evaluation of alternatives, determination of the existence of needed technology, and the final selection of alternatives for the SBITA. Costs associated with this stage are NOT capitalized.

- Initial implementation stage, which includes design, configuration and interfaces, coding, installation of hardware, installation and licensing of commercially available software, and testing, including parallel processing. This includes data conversion only to the extent it is necessary to make the software operational. Costs associated with this phase ARE capitalized when BOTH of the following occur:

- Activities of the preliminary project stage are completed.

- Management implicitly or explicitly authorizes and commits to funding the software project

Capitalization of costs should cease when the SBITA asset is placed into service. If a SBITA has more than one module, the asset is considered placed into service when initial implementation is completed for the first independently functional module or for the first set of interdependent modules. Remaining modules should be considered subsequent implementation outlays and should be capitalized if they would be considered a betterment or improvement.

- Post-implementation/operation stage, which includes maintenance, troubleshooting, and other data conversion costs. Costs associated with this stage are NOT capitalized.

Training costs, regardless of the stage they occur in, cannot be capitalized and should be recorded as a current period expenditure/expense.

Contracts with multiple assets or components and multiple contracts. In general, the capitalization threshold should be applied to each contract (rather than each asset within the contract). SBITAs that are entered into under a master vendor agreement are separate contracts. However, if multiple contracts are entered into at or near the same time with the same vendor, negotiated as a package with a single objective, and the amount to be paid in one contract depends on the price or performance of the other contract, then the contracts should be combined and considered a single contract.

If a contract contains both a subscription component (such as the right to use IT assets) and a non-subscription component (such as maintenance services), then the subscription and non-subscription components should be treated as separate contracts. The subscription component is subject to all requirements for SBITAs; whereas, the non-subscription component should be recognized as a current period expenditure/expense.

If a contract involves multiple underlying assets with different subscription terms, each asset or group of assets with a different subscription term should be treated as a separate contract.

If a contract does not include prices for individual components or assets, an estimate should be used to allocate the contract price to those components. However, if a reasonable estimate cannot be determined, then the contract should be treated as a single subscription contract.

40.60.40.3 Accounting for SBITAs

Subscription-based IT arrangement (SBITA) assets are to be capitalized at the value of the sum of the initial measurement of the SBITA liability, plus any ancillary and implementation charges, and/or SBITA payments made to the vendor at or before the commencement of the subscription term, less any incentives received from the vendor at or before the commencement of the subscription term.

Accounting for SBITAs consists of:

- Recording the subscription asset and liability at the commencement of the contract term,

- Updating DebtBook,

- Separating periodic payments into principal and interest portions,

- Applying payments to the correct object of expenditure, and

- Amortizing the subscription asset

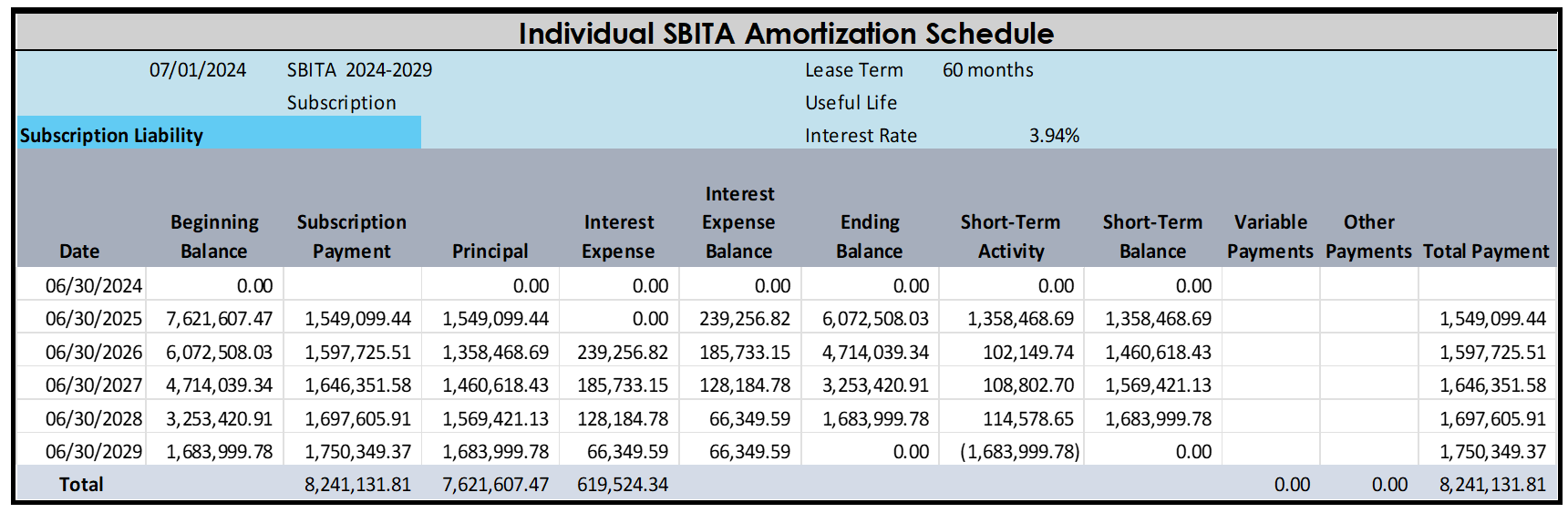

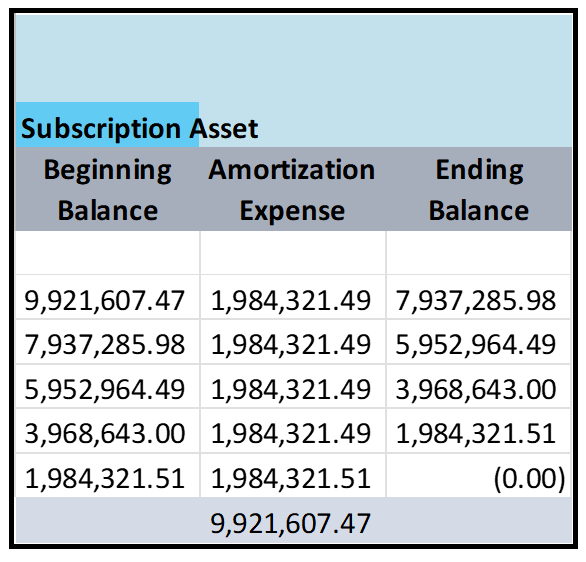

The following amortization schedule from DebtBook is the basis for the amounts in the following illustrative entries and instructions assuming $2,300,000 in implementation costs.

Image: SBITA Amortization Schedule Subscription Liability

Image: SBITA Amortization Subscription Asset

To capitalize implementation costs as construction in progress until the SBITA is placed into service (if there are no implementation costs, ignore this step).

Fund 997

| Account | Account Description | DR | CR |

|---|---|---|---|

| 1120020 | Construction in Progress | $ 2,300,000.00 | |

| 3000050 | Investment in General Capital Assets | 2,300,000.00 |

Operating (Governmental) Fund

In governmental funds, the recording for a SBITA asset acquisition at commencement of the subscription term, is recorded by the following series of entries:

| Account | Account Description | DR | CR |

|---|---|---|---|

| 5040275 | SBITA Asset Acquisition | $ 7,621,607.45 | |

| 4040200 | Other Finance Sources/subscription Acquisition | 7,621,607.45 |

Fund 997 – General Capital Assets Subsidiary

| Account | Account Description | DR | CR |

|---|---|---|---|

| 1122100 | SBITA Asset | $ 7,621,607.45 | |

| 3000050 | Investment-General Capital Assets | 7,621,607.45 |

Fund 999 – General Long-Term Obligations Subsidiary

| Account | Account Description | DR | CR |

|---|---|---|---|

| 1110040 | Amount Provided-Retirement of Long-term Obligations | $ 7,621,607.27 | |

| 2050200 | SBITA Agreement Payable ST | 1,549,099.24 | |

| 2140200 | SBITA Agreement Payable LT | 6,072,508.03 |

Fund 997

To reclassify capitalized implementation costs from CIP to the SBITA asset. The asset will be amortized using the straight-line method over the SBITA term.

| Account | Account Description | DR | CR |

|---|---|---|---|

| 1122100 | SBITA Asset | $ 2,300,000.00 | |

| 1120020 | Construction in Progress | 2,300,000.00 |

Periodic SBITA Agreement Payments

Periodic subscription payments represent debt service expenditures in governmental fund type accounts. SBITA payments are expensed in account 5081230 with a state purpose of “Y”. Because the Y needs to remain, the following set of entries are made with a state purpose of “N” in governmental funds.

| Account | Account Description | DR | CR |

|---|---|---|---|

| 5040730 | Exp Adj/Elim - SBITA Princ | $ 1,549,099.44 | |

| 5040740 | Exp Adj/Elim - SBITA Interest | 0.00 | |

| 5040750 | Exp Adj/Elim - SBITA | 1,549,099.44 |

Short-Term Liability/Amortization Adjustment

Reduce the short-term liability by annual payments amount:

Fund 999

| Account | Account Description | DR | CR |

|---|---|---|---|

| 2050200 | SBITA Agreement Payable ST | $ 1,549,099.44 | |

| 1110040 | Allow for Amort. – SBITA Asset | 1,549,099.44 |

Amortization Entries

The SBITA asset should be amortized using the straight-line method over the shorter of the subscription term or the asset useful life. Amortization Expense and Allowance for Amortization are recorded as follows:

Fund 997

| Account | Account Description | DR | CR |

|---|---|---|---|

| 5070040 | Gov’t – Depreciation (Amort) Expense | $1,984,321.49 | |

| 1122110 | Allow for Amort. – SBITA asset | 1,984,321.49 |

Liability Reclassification Entries

At year-end, reclassify the amount due within one year from long-term to short-term.

Fund 999

| Account | Account Description | DR | CR |

|---|---|---|---|

| 2140200 | SBITA Liability LT | $1,358,468.69 | |

| 2050200 | SBITA Liability ST | 1,358,468.69 |

End of Agreement Entries

At the end of the subscription, remove the capital asset when the agreement ends. If the agreement is cancelled early and the asset was not fully amortized (i.e. the cost is greater than the accumulated amortization), debit account 5070070-Gov’t Capital Asset Adjust for the difference between the initial cost of the asset and the accumulated amortization.

Fund 997 – Remove Asset and Related Entries

| Account | Account Description | DR | CR |

|---|---|---|---|

| 1122110 | Allow. For Amortization – Asset | $5,952,964.47 | |

| 5070070 | Capital Asset Adjustment | 3,968,643.00 | |

| 1122100 | SBITA Asset – Equipment Account | 9,921,607.47 |

Fund 4xx or 5xx Purchasing Fund

To capitalize implementation costs as construction in progress until the SBITA is placed into service (if there are no implementation costs, ignore this step).

| Account | Account Description | DR | CR |

|---|---|---|---|

| 1120020 | Construction in Progress | $ 2,300,000.00 | |

| 5040750 | Exp Adj/Elim - SBITA | 2,300,000.00 |

Fund 4xx or 5xx Purchasing Fund

In proprietary funds, the recording for a SBITA asset acquisition at commencement of the subscription term is recorded by the following entry:

| Account | Account Description | DR | CR |

|---|---|---|---|

| 1122100 | SBITA Asset | $ 7,621,607.47 | |

| 2050200 | SBITA Agreement Pay - ST | 1,549,099.44 | |

| 2140200 | SBITA Agreement Pay – LT | 6,072,508.03 |

To reclassify capitalized implementation costs from CIP to the SBITA asset. The asset will be amortized using the straight-line method over the SBITA term.

| Account | Account Description | DR | CR |

|---|---|---|---|

| 1122100 | SBITA Asset | $ 2,300,000.00 | |

| 1120020 | Construction in Progress | 2,300,000.00 |

Periodic Subscription Payments

Periodic subscription payments represent debt service expenditures in governmental fund type accounts. SBITA payments are expensed in account 5081230 with a state purpose of “Y”. Because the Y needs to remain, the following set of entries are made with a state purpose of “N” in governmental funds.

| Account | Account Description | DR | CR |

|---|---|---|---|

| 2050200 | SBITA Agreement Payable ST | $1,549,099.44 | |

| 5040740 | Exp Adj/Elim - SBITA Interest | 0.00 | |

| 5040750 | Exp Adj/Elim - SBITA | 1,549,099.44 |

Budgeted Proprietary Fund

If the agreement is made through a budgeted proprietary fund, the entries needed to account for annual payments are different. Please contact SBCTC if you have a SBITA in a budgeted proprietary fund.

Amortization

The subscription asset should be amortized using the straight-line method over the shorter of the subscription term or the asset useful life. Amortization Expense and Allowance for Amortization are recorded as follows in the proprietary fund:

Fund 4xx or 5xx Purchasing Fund

Record amortization expense and allowance:

| Account | Account Description | DR | CR |

|---|---|---|---|

| 5070020 | Prop - Amortization Expense (Assets) | $ 1,984,321.49 | |

| 1122110 | Allow for Amortization – SBITA asset | 1,984,321.49 |

Reclassification Entries

At year-end, reclassify the amount due within one year from long-term to short-term.

| Account | Account Description | DR | CR |

|---|---|---|---|

| 2140200 | SBITA Liability Long-Term | $1,358,468.69 | |

| 2050200 | SBITA Liability Short-Term | 1,358,468.69 |

End of Subscription Entries

At the end of the subscription, remove the capital asset. If the subscription is cancelled early and the asset was not fully amortized (i.e. the cost is greater than the accumulated amortization), debit account 4130010 - Gain/Loss Sale Capital Asset for the difference between the initial cost of the asset and the accumulated amortization.

Fund 4xx/5xx – Remove Asset and Related Entries:

| Account | Account Description | DR | CR |

|---|---|---|---|

| 1122110 | Allow. For Amortization – Asset | $5,952,964.47 | |

| 4130010 | Gain/Loss Sale Capital Asset | 3,968,643.00 | |

| 1122100 | SBITA Asset – Equipment Account | 9,921,607.47 |

40.60.30.3 Proprietary Funds (Lessor) << 40.60.40 >> 40.70 Accounting for Certificates of Participation (COPs)