ctcLink Accounting Manual | 40.90 Payroll Accounting

40.90 Payroll Accounting

2025-01-01

While each college maintains a separate bank account for locally written checks (accounts payable), ctcLink HCM uses one bank account to produce payroll checks for all the colleges in the system. This account is managed and maintained at the State Board for Community and Technical Colleges (SBCTC). Using a single bank account and making a single draw from the State Treasurer is required by the State since our system is a single agency (6990) in the state accounting and banking systems.

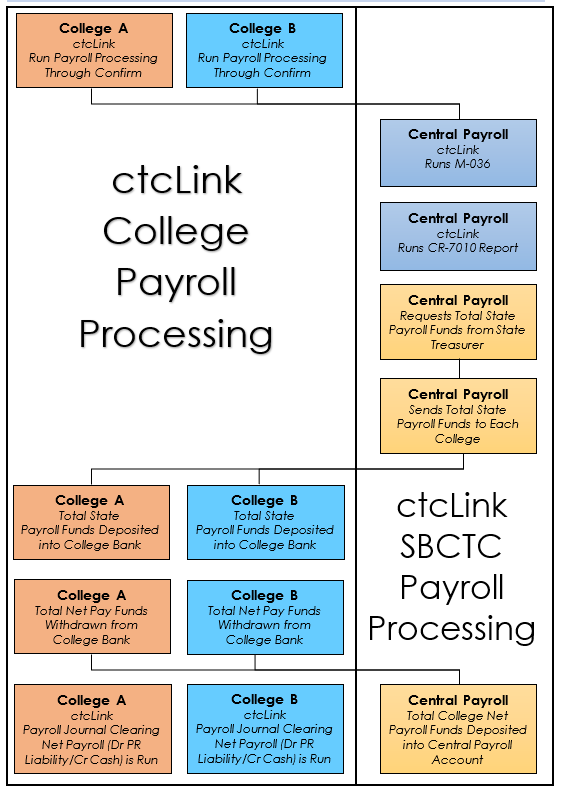

40.90.10.1 Payroll Process Overview

The process, depicted graphically below, has these basic steps:

- Colleges complete payroll process through ‘Confirm.’

- Central Payroll runs the M-036 process.

- Central Payroll runs the CR-7010/CR-7020 report to determine the total state funded payroll and net pay from all funds.

- Central Payroll requests total state funds from the State Treasurer.

- Central Payroll deposits total state funds per college into the college bank account.

- Central Payroll withdraws total net pay for all funds from the college bank account.

- Colleges create payroll journals clearing net pay liabilities. Since cash was withdrawn from the college bank, deposited into Central Payroll bank and since Central Payroll now has a Net Pay Liability for college employee’s pay the colleges must record an entry: Dr Net Pay Liability/Cr Cash in Bank. Not shown below:

- Central Payroll issues a paycheck or ACH/Direct Deposit for college system employees.

- Colleges must also record the VPA (Dr Cash in Bank/Cr VPA Revenue by state fund in Fund 790-285-98499). DO NOT DRAW FUNDS FROM THE TREASURER FOR PAYROLL.

Once payroll has been scheduled and processed, and overnight job is scheduled to post ctcLink HCM data to FIN General Ledger on payroll cutoff plus one day.

Payroll processing

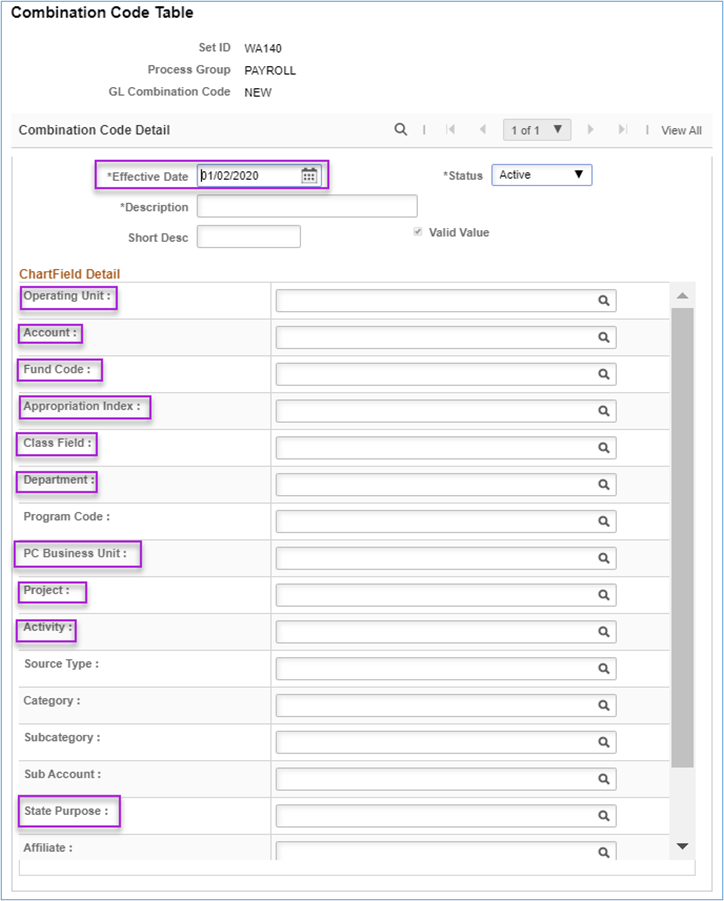

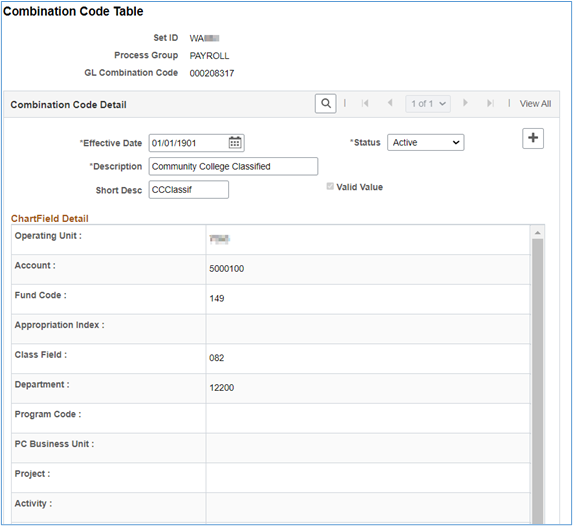

ctcLink payroll accounting begins with combination codes.

A chartfield combination code (i.e. Combo Code) is a shorthand value which represents a specific chartstring.

Example: Combo Code 000169611 represents:

- Operating Unit – 7170 (Spokane District)

- Account – 5000100 (Community College Classified)

- Fund – 001 (State General Fund)

- Appropriation Index - 101 (State General Fund)

- Class – 083 (General Support Services)

- Department – 35932 (Purchasing)

- State Purpose – N (not IT related)

Some Combo Codes have additional chartfields (see below for a list of available chartfields).

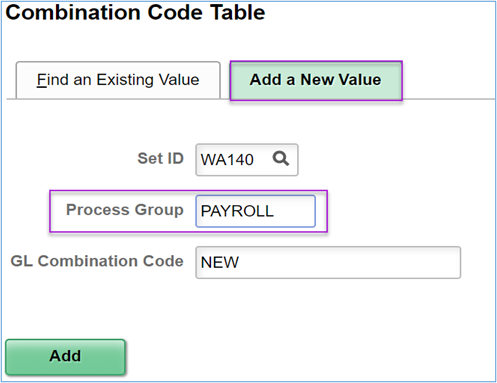

40.90.20.1 Creating Combination Codes

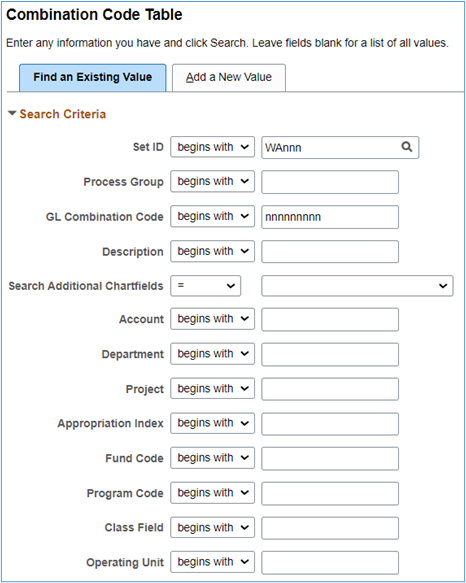

To create new combination codes permissions are required in HCM to the Combination Code Table: “NavBar > Menu > Set Up HCM > Common Definitions > ChartField Configuration > Combination Code Table > Add a New Value”.

Combination Code Table

Combination Code Table Fields

40.90.20.2 Combination Codes Available Chartfields

The following fields are available in the configuration table:

| Chartfields | Usage |

|---|---|

| Combination Code | System Generated |

| Description | Add a useful description |

| Short Desc | Not Required |

| Account | Required |

| Department | Required |

| Project | Required for Grants and Capital Projects |

| Appropriation Index | Required |

| Fund Code | Required |

| Program Code | College Option |

| Class Field | Required |

| Affiliate | Not Used |

| Operating Unit | Required |

| Alternate Account | Not Used |

| Budget Reference | Not Required |

| Sub Account (Due To/From) | Not Required |

| State Purpose (IT) | Required |

| ChartField 3 | Not Used |

| PC Business Unit | Required for Grants and Capital Projects |

| Activity | Required for Grants and Capital Projects |

| Source Type | Required for Projects |

| Category | Required for Projects |

| Subcategory | Required for Projects |

40.90.20.3 Combination Code Accounting

Each employee must be assigned a valid chartstring to ensure payroll expenses are charged correctly.

When payroll information is processed and journalized into HCM the combo code numbers are replaced in accounting chartstring represented by the combo code. However, job codes and amounts can be matched when comparing FIN and HCM payroll journals. This is especially helpful when reconciling grant-related payroll.

Be aware HCM does not have edit checks in place so an invalid chartstring will be loaded to the FIN journals. Colleges will be required to correct the GL journals prior to posting.

This will result in differences between the HCM journals and FIN journals.

For information on working with Combo Codes see the following QRGs:

The Combo Code determines the chartstring to which payroll expenses for each employee is charged but deduction code table configurations determine the accounts.

40.90.30.1 Payroll Expense Accounts

Employee salary expenses accounts are determined by employee type to allow to required reporting to the State:

| Account | Description |

|---|---|

| 5000010 | Exempt Executive |

| 5000020 | Exempt Managerial |

| 5000030 | Exempt Professional/Technical |

| 5000040 | Exempt Support Staff |

| 5000050 | Exempt Temporary |

| 5000060 | Faculty Permanent FT |

| 5000070 | Faculty Permanent PT |

| 5000080 | Faculty Temporary FT |

| 5000090 | Faculty Temporary PT |

| 5000100 | Community College Classified |

| 5000110 | Classified PT Hourly |

| 5000115 | Classified PT Hourly Temporary |

| 5000120 | Technical College Classified |

| 5000130 | Higher Education Students |

| 5000140 | Work Study Students - State |

| 5000145 | Work Study Students - Federal |

| 5000150 | Sick Leave Buyout |

| 5000160 | Terminal Leave |

| 5000170 | Overtime |

| 5000180 | Higher Education Other |

| 5000190 | Tech Coll Classified PT Hourly |

| 5000200 | Trustees |

| 5010170 | Payroll Suspense |

Entire employee salary for the pay period is charged to one of these expense accounts with an offset to the Net Pay Liability account (2011015). Each employee (EE) deduction results in the reduction of the Net Pay Liability and an increase in the specific deduction liability. Employer contributions also have distinct expense and liability accounts that increase college payroll expenses but do not impact employee pay or net pay.

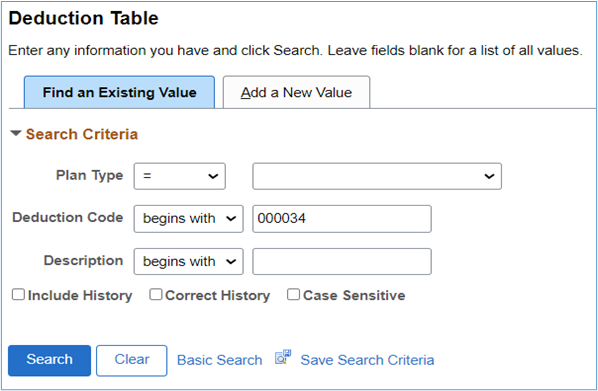

40.90.30.2 General Deduction Codes

The Combo Code determines the chartstring to which payroll expenses for each employee are charged.

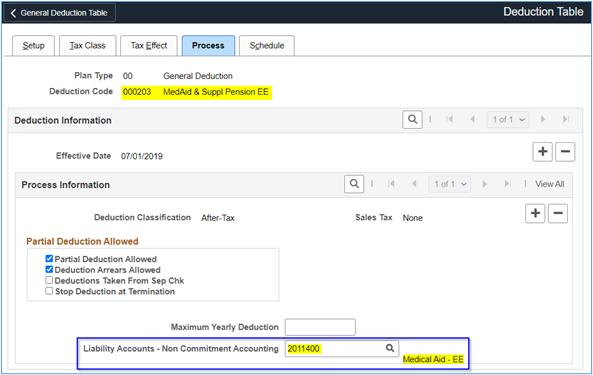

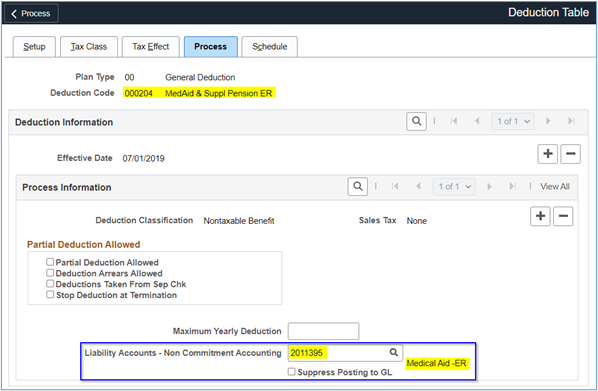

However, the Deduction Code tables determine the liability accounts. Each employee deduction code reduces the amount of the net pay liability. In addition, employer deduction codes add to the total payroll expenses and liabilities. See CLAM 40.90.40.2

To find the liability account each deduction is charged to:

NavBar > Menu > Set Up HCM > Product Related > Payroll for North America > Deductions > Deduction Table and select Plan Type and/or a Deduction Code.

Different deduction codes and liability accounts have been established for both the employee (EE) and employer (ER) portion to allow for easier reconciliation and error identification.

Deduction Table

Employee Portion

Employer Portion

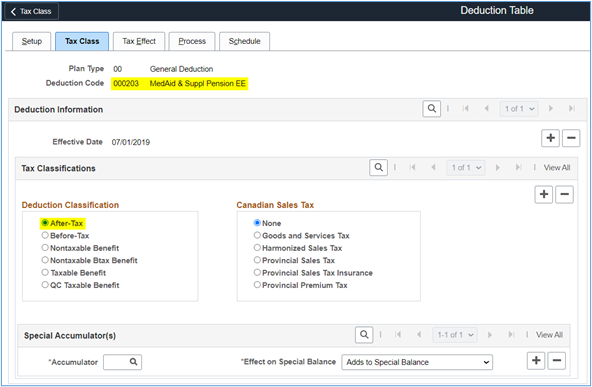

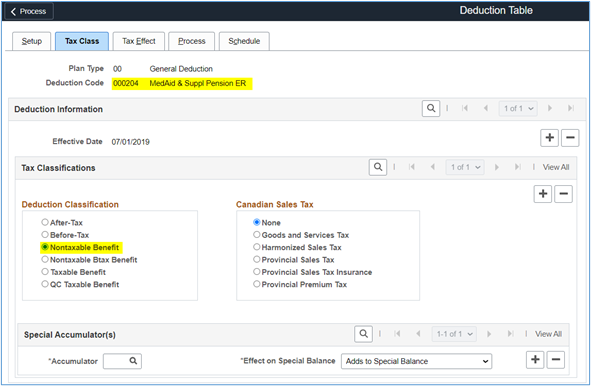

40.90.30.3 Deductions Tax Treatment

The Deduction Code tables also determine the tax treatment of each benefit:

Employee Portion

Employer Portion

40.90.30.4 Company Payroll Liabilities

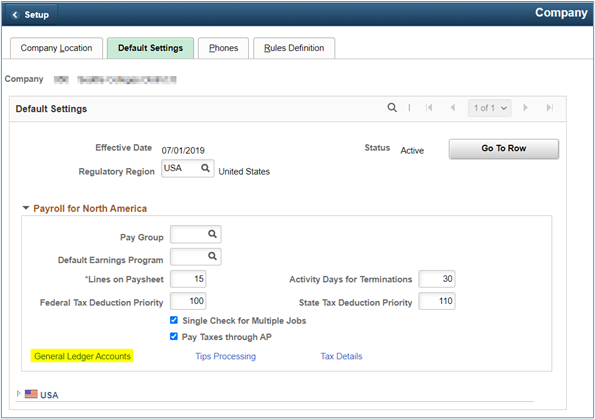

Each college has specific configurations set up here:

NavBar > Menu > Set Up HCM > Foundation Tables > Organization > Company > Tab: Default Settings > Link: General Ledger Accounts

Payroll liabilities setup

Payroll liabilities GL accounts

With the ‘Distribute Expense’ box checked; the system distributes the cost of benefits according to the percentage of total earnings the employee earned in each department. If this box is not checked, all expenses are distributed to the employee's home department.

40.90.30.5 Payroll Liability Account Complete List

Abbreviation legend

- EE = Employee

- ER = Employer

- PP = Prepay (Faculty Only)

| Account | Description |

|---|---|

| 2011004 | Payroll/HCM Payables (Budgetary Only) |

| 2011010 | Accr Sal and Frng Ben Pybl ST (Legacy) |

| 2011015 | Payroll Net Pay Liability |

| 2011020 | WAPAY Net Pay Liability |

| 2011025 | Federal Income Taxes |

| 2011027 | State Income Tax |

| 2011028 | State Income Tax - ER |

| 2011030 | OASI - ER |

| 2011035 | OASI - EE |

| 2011040 | Medicare - ER |

| 2011045 | Medicare - EE |

| 2011050 | TwinStar CU |

| 2011055 | TwinStar CU - PP |

| 2011060 | WSECU |

| 2011065 | WSECU - PP |

| 2011070 | School Employees CU |

| 2011075 | School Employees CU - PP |

| 2011080 | PERS Plan 1 - ER |

| 2011085 | PERS Plan 1 - EE |

| 2011090 | PERS Plan 2 - ER |

| 2011095 | PERS Plan 2 - EE |

| 2011100 | PERS Plan 3 WSIB - ER |

| 2011105 | PERS Plan 3 WSIB - EE |

| 2011110 | PERS Plan 3 Self Investment - ER |

| 2011115 | PERS Plan 3 Self Investment |

| 2011120 | SBRP (TIAA-CREF) - ER |

| 2011125 | SBRP (TIAA-CREF) - EE |

| 2011130 | 403(b) - Negotiated - ER |

| 2011135 | 403(b) - Negotiated - EE |

| 2011140 | SRP Pre & After Tax - ER |

| 2011145 | SRP Pre & After Tax - EE |

| 2011150 | HERP Supplemental |

| 2011155 | TRS Plan 1 - ER |

| 2011160 | TRS Plan 1 - EE |

| 2011165 | TRS Plan 2 - ER |

| 2011170 | TRS Plan 2 - EE |

| 2011175 | TRS 3 WSIB - ER |

| 2011180 | TRS 3 WSIB - EE |

| 2011185 | TRS 3 Self Investment - ER |

| 2011190 | TRS 3 Self Investment - EE |

| 2011195 | Deferred Comp |

| 2011200 | Deferred Comp - PP |

| 2011205 | Other Retirement Deductions |

| 2011210 | Other Retirement Deductions - PP |

| 2011215 | Employee Ins Deduction, Short-Term |

| 2011220 | Uniform Classic |

| 2011225 | Uniform Classic - PP |

| 2011230 | Benefits Payable-Short-Term |

| 2011235 | Uniform CDHP |

| 2011236 | Uniform Select |

| 2011240 | Uniform CDHP - PP |

| 2011241 | Uniform Select - PP |

| 2011245 | UMP+PS High Value Network |

| 2011250 | UMP+PS High Value Network - PP |

| 2011255 | UMP + UW Medicine ACN |

| 2011260 | UMP + UW Medicine ACN - PP |

| 2011265 | Kaiser/Group Health Classic |

| 2011270 | Kaiser/Group Health Classic - PP |

| 2011275 | Kaiser/Group Health CDHP |

| 2011280 | Kaiser/Group Health CDHP - PP |

| 2011285 | Kaiser/Group Health Value |

| 2011290 | Kaiser/Group Health Value - PP |

| 2011295 | Kaiser/Group Health Sound Choice |

| 2011300 | Kaiser/Grp Health Sound Choice - PP |

| 2011305 | HCA Average Cost - ER |

| 2011310 | Spousal Medical Surcharge |

| 2011315 | Spousal Medical Surcharge - PP |

| 2011320 | Tobacco User Medical Surcharge |

| 2011325 | Tobacco User Medical Surcharge - PP |

| 2011330 | Uniform Dental |

| 2011331 | Davis Vision |

| 2011332 | Eye Med Vision |

| 2011333 | MetLife Vision |

| 2011335 | Willamette Dental |

| 2011340 | Delta Care Dental |

| 2011345 | FSA- Admin |

| 2011350 | Flex Spending Dependent Care |

| 2011355 | Flex Spend Dependent Care - PP |

| 2011360 | Health Savings Account |

| 2011365 | Health Savings Account - PP |

| 2011370 | VEBA - ER |

| 2011375 | VEBA - EE |

| 2011380 | VEBA - PP |

| 2011385 | Flex Spending Health - U.S. |

| 2011390 | Flex Spending Health - U.S. - PP |

| 2011395 | Medical Aid - ER |

| 2011400 | Medical Aid - EE |

| 2011405 | Industrial Insurance - ER |

| 2011410 | Medaid Preferred - ER |

| 2011415 | Medaid Preferred - EE |

| 2011420 | Medaid Volunteers |

| 2011455 | Long-Term Disability - Basic |

| 2011460 | Long-Term Disability - Optional |

| 2011465 | Long-Term Disability – Opt - PP |

| 2011470 | AFLAC |

| 2011475 | AFLAC - PP |

| 2011480 | Colonial Life Insurance |

| 2011485 | Colonial Life Insurance - PP |

| 2011490 | MetLife |

| 2011495 | MetLife - PP |

| 2011500 | Liberty Mutual |

| 2011505 | Liberty Mutual - PP |

| 2011510 | Other Life |

| 2011515 | Other Life - PP |

| 2011520 | Worker's Compensation |

| 2011525 | WEA/NEA |

| 2011530 | WEA/NEA - PP |

| 2011535 | WPEA |

| 2011540 | WPEA - PP |

| 2011545 | WFSE |

| 2011550 | WFSE - PP |

| 2011555 | WFT |

| 2011560 | WFT - PP |

| 2011565 | AFT |

| 2011570 | AFT - PP |

| 2011575 | UFCW |

| 2011580 | UFCW - PP |

| 2011585 | Other |

| 2011590 | Other - PP |

| 2011595 | Pretax Parking |

| 2011600 | Taxable Parking |

| 2011605 | Combined Fund Drive |

| 2011610 | Combined Fund Drive - PP |

| 2011615 | GET Program |

| 2011620 | GET Program - PP |

| 2011625 | Foundation |

| 2011630 | Foundation - PP |

| 2011635 | Other College Specific |

| 2011640 | Other College Specific - PP |

| 2011645 | All Garnishments |

| 2011650 | All Garnishments - PP |

| 2011655 | Due to Deceased Employee's Est |

| 2011660 | Paid Family & Medical leave - ER |

| 2011670 | Paid Family & Medical leave - EE |

| 2011680 | EE DreamAhead Investment Program |

| 2011690 | EE DreamAhead Invest Program - PP |

| 2011705 | Unemployment Tax - ER |

| 2011710 | Long Term Care Premium |

State accounting rules require different expense accounts for each benefit expense type. Since this functionality was not part of the original Peoplesoft design, custom tables were created to map some earnings, deductions and tax expense accounts.

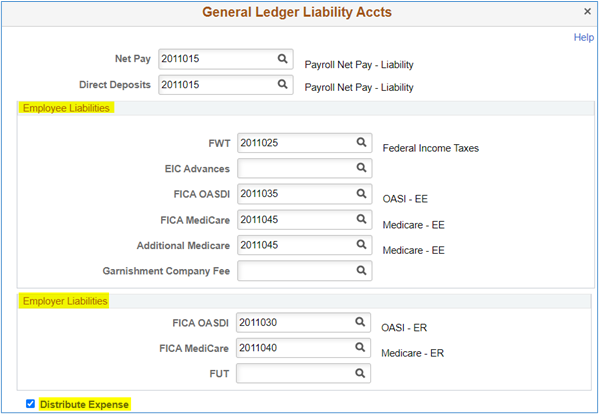

40.90.40.1 GL Earnings Expense Account Mapping

The salary and wages expense accounts are established in the combination code used for each employee.

NavBar > Menu > Set Up HCM > CTC Custom > CTC GL Account Mapping.

Some colleges have elected to use different expense accounts for special pay like overtime or cellphone stipends which are configured in the GL Earning Account Mapping of the CTC GL Account Mapping page.

GL earnings account mapping

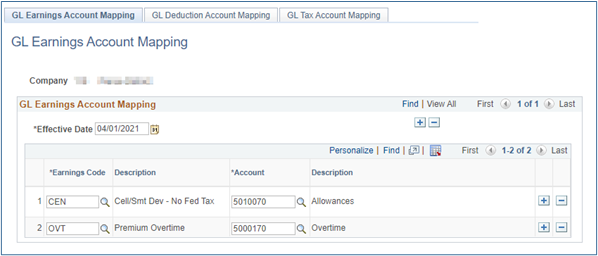

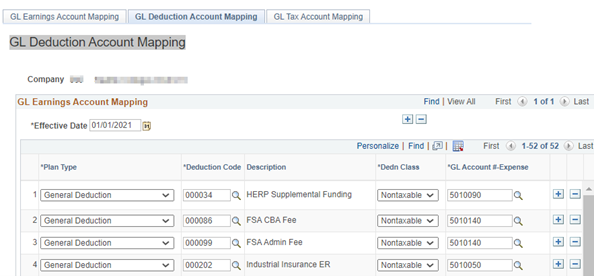

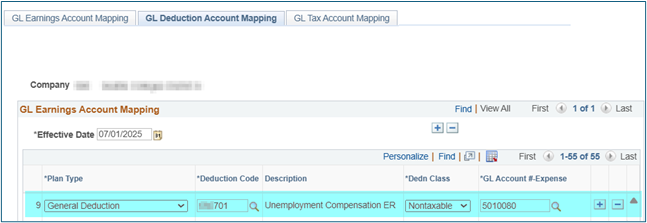

40.90.40.2 GL Deduction Expense Account Mapping

The employer share of each deduction (discussed above), sometimes referred to as the employer contribution, is assigned the required expense account and used during journal generation to create the correct accounting entries.

IMAGE gl-deduction-account-mapping-40-90-40-2

GL deduction account mapping

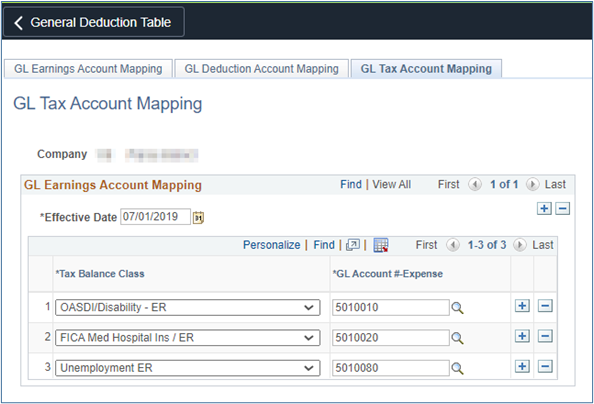

40.90.40.3 GL Tax Expense Account Mapping

The employer share of tax deductions (discussed above), sometimes referred to as the employer contribution, is assigned the required expense account and used during journal generation to create the correct accounting entries.

IMAGE gl-tax-expense-account-mapping-40-90-40-3

GL tax expense account mapping

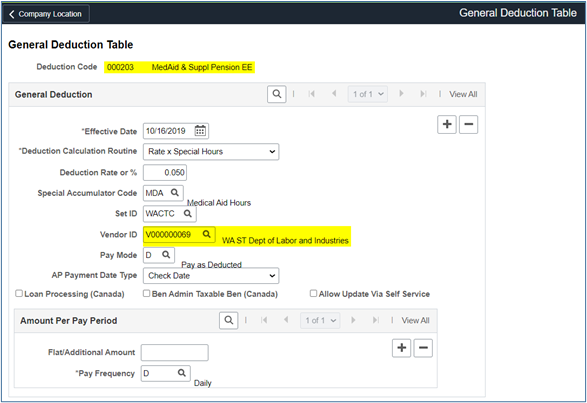

40.90.40.4 Payroll Vendor Configuration

The vendor ID, amount/percentage, date, and frequency of deductions are established on the General Deduction Table.

NavBar > Menu > Set Up HCM > Product Related > Payroll for North America > Deductions > General Deduction Table.

General deduction table

40.90.50 Processing Payroll Vouchers

40.90.50.1 Payroll Dates

Payroll cut off dates on the 15th with a pay date of the 25th (or nearest business day) and last day of the month with a pay date of the 10th of the following month (or nearest business day).

For most payrolls, college payroll staff must complete payroll confirm 5 business days prior to the paydate and checks should be printed 4 days prior to paydate. Occasionally due to holidays the number of days may be adjusted.

40.90.50.2 HCM and FIN Payroll Data

A HCM detail journal will be generated overnight after payroll is confirmed by each college with the expense/liability entries based on the combo codes and payroll configuration. The process creates the table HR Acctng Ln in HCM. The HCM table pushes summary accounting detail to FIN creating a table called the HR Acctng Ln.

The difference between the HCM HR Acctng Line and the FIN HR Acctng Line tables is the level of detail. HCM contains all the distribution details including employee names, EmplIDs, earning and deductions and so forth. The FIN table has only summary accounting data without employee information.

With appropriate access to HCM Query Viewer the following queries provide detail information for each pay period:

- CTC _HR_ACCTNG_LINE_PAY_PERIOD. This table lists each earning type, each deduction, employee IDs, names and accounting chartstrings.

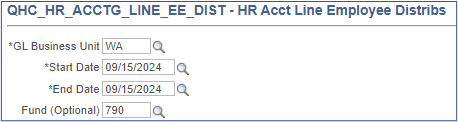

- CTC_HR_ACCTG_LINE_EE_DIST provides employee IDs, names and expenses and liabilities by chartstring.

(PAY Journal). These journals must be posted “as is” before the month closes.

40.90.50.3 Posting ‘PAY’ Journals

All journals created in HCM and posted in the Finance general ledger have the prefix ‘PAY’. Payroll journals do not run through budget or combo edit checks and therefore may not post due to errors.

Therefore, prior to posting PAY journals, invalid chartstrings may need to be corrected. Only the posting errors should be corrected since the payroll expense MUST equal the funds Central Payroll requested on the college’s behalf from the State Treasurer and drawn from the college bank account!

If the expense/liability journal is modified, then the same changes must be made to each voucher upload (Net Pay and Payroll Liabilities). This increases the likelihood of errors that will need to be fixed with journals entries. This also creates a variance between the source record (HCM Acctng Ln table) and the posted journal in FIN.

If other errors are identified that do not prevent the journal from being posted, colleges should create a second general journal to make the corrections to the payroll.

40.90.50.4 Relieving Net Pay

Since the PAY journals create liability credits, and the System Payroll has either issued checks or created a direct deposit for the employee’s pay, net pay liabilities must be relieved.

This is accomplished by:

- Running the ‘CTC_HR_ACCTG_NET_PAY_DIST’ query in HCM.

- Uploading the results using the process described in the QRG 9.2 Create Voucher Using a Voucher Upload Process.

- Marking all vouchers for Net Pay as ‘Manually Paid’

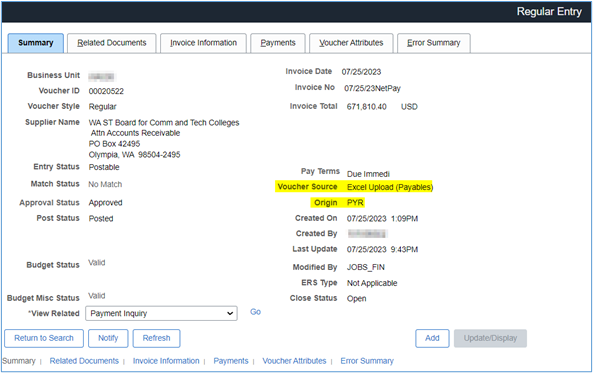

The voucher can be reviewed here: NavBar > Menu > Accounts Payable > Vouchers > Add/Update > Voucher Search

After completing upload/import of the Net Pay voucher the screens have these values/characteristics:

Summary Tab

- The Voucher Source = Excel Upload (Payables)

- Origin = PYR

- Supplier Name = WA ST Board for Comm and Tech Colleges

Relieving net pay invoice summary

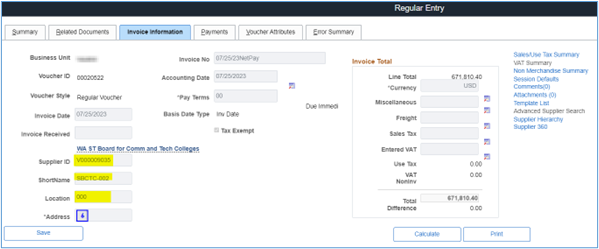

Invoice Information Tab

- Tax Exempt = Checked. If this box is not checked, the voucher will record an expense to Use Tax!

- Supplier ID = V000009035

- Location = 000

- Address = 6

Relieving net pay invoice info, part 1

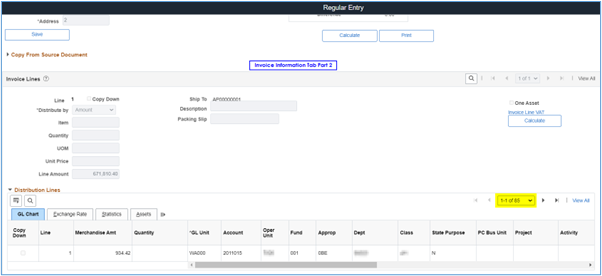

Lower portion of this tab contains all accounting distribution lines included in the Net Pay voucher (in this example the voucher contained 85 lines of summary payroll accounting lines:

Relieving net pay invoice info, part 2

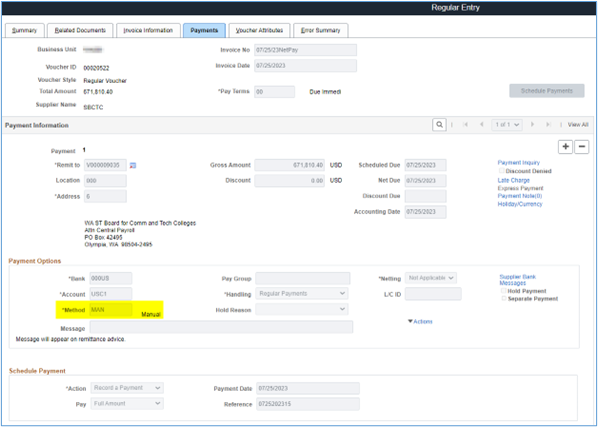

Payments Tab

- Payment Options section should contain college bank information.

- Method = MAN (this must be manual since the central payroll process has already drawn the funds from the college bank account).

Relieving net pay invoice payment

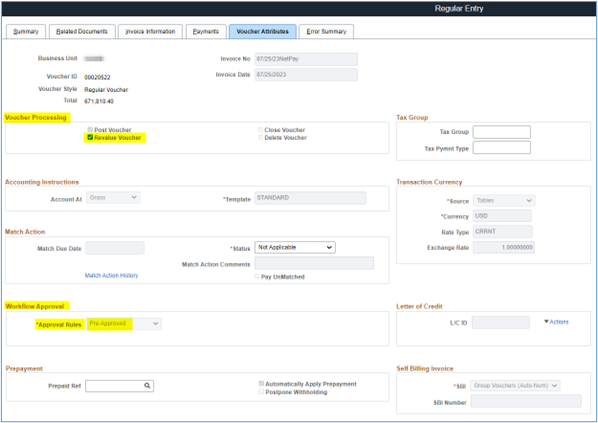

Voucher Attributes Tab

- Voucher Processing is set to ‘Revalue Voucher’.

- Workflow Approval/Approval rules is set to ‘Pre-Approved’ since approval occurred in payroll.

Relieving net pay invoice voucher

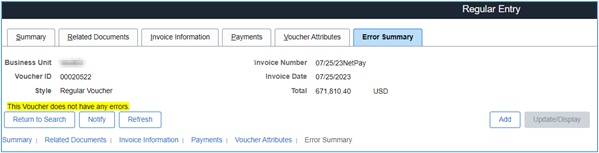

Error Summary Tab

- Errors (if any) are listed here:

Relieving net pay invoice error

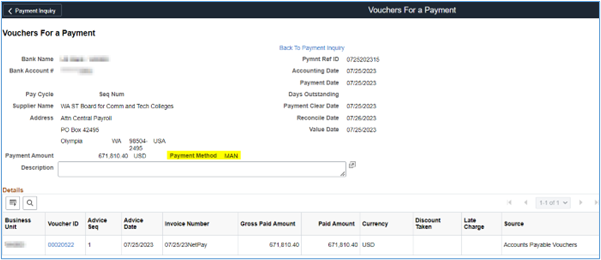

Summary Tab – Payment Inquiry Link

- Selecting ‘Go’ for the Payment Inquiry will display the Vouchers For a Payment screen

Relieving net pay invoice inquiry

40.90.50.5 Relieving Payroll Liabilities

When payroll processing is complete, HCM pushes payroll liabilities to the Voucher Build Staging Tables. To generate vouchers in FIN, it is necessary to run the process as described in QRG 9.2 Process Payroll Vouchers.

This provides the step-by-step process for:

- Voucher Build Request. The Voucher Build process then builds voucher records from the staged data and writes them to the PeopleSoft Payables voucher tables. The process only accepts data for new vouchers. Vouchers that already exist in the PeopleSoft Payables voucher tables must be updated online using the Voucher component or the Voucher Maintenance component.

- Voucher Budget Check, Approval and Review.

- Voucher Payment Options. Colleges MUST be aware of which vouchers should be checked as manually paid (i.e. paid outside of ctcLink). The vouchers marked with an asterisk (*) below are typically paid outside of ctcLink and should be marked manually paid.

Colleges MUST also be aware of which payments occur outside the system. See guidance in this section of the QRG for step-by-step processing.

To review the list of payroll vouchers to be paid run the query in HCM: CTC_AP_EXTRACT_SUMMARY. Typical results should look like this:

AP Extract Summary

| Vendor | Name | Invoice | Date | Sum Amount |

|---|---|---|---|---|

| 0000045380 | Metropolitan Life* | H0070790 | 8/10/2023 | 4,070.09 |

| 0000048029 | Oregon Department of Revenue* | H0070891 | 8/10/2023 | 1,495.90 |

| 0000050798 | State of California - EDD* | H0070892 | 8/10/2023 | 2,375.09 |

| 0000057880 | Oregon Department of Revenue* | H0070893 | 8/10/2023 | 232.07 |

| 0000059055 | Alabama Department of Revenue* | H0070894 | 8/10/2023 | 336.29 |

| 0000059442 | Missouri Department of Revenue* | H0070895 | 8/10/2023 | 230.00 |

| 0000060200 | Employment Security Department | H0070896 | 8/10/2023 | 5,162.29 |

| V000000012 | TIAA 101308 | H0070792 | 8/10/2023 | 110,953.43 |

| V000000018 | Washington State Support Registry | H0070805 | 8/10/2023 | 237.00 |

| V000000021 | WA St Health Care Authority | H0070795 | 8/10/2023 | 25,932.79 |

| V000000023 | Liberty Mutual Insurance | H0070796 | 8/10/2023 | 422.38 |

| V000000038 | Combined Fund Drive | H0070798 | 8/10/2023 | 78.50 |

| V000000053 | DRS - PERS II | H0070800 | 8/10/2023 | 38,016.93 |

| V000000055 | Deferred Compensation | H0070801 | 8/10/2023 | 20,062.08 |

| 0000048029 | Oregon Department of Revenue* | H0070809 | 8/10/2023 | 80.24 |

| 0000048029 | Oregon Department of Revenue* | H0070890 | 8/10/2023 | 20.33 |

| 0000059208 | City of Birmingham* | H0070810 | 8/10/2023 | 36.52 |

| V000000008 | HealthEquity Inc | H0070791 | 8/10/2023 | 2,396.33 |

| V000000015 | DRS - PERS III SELF | H0070793 | 8/10/2023 | 13,031.17 |

| V000000020 | Employment Security Department | H0070794 | 8/10/2023 | 6,608.28 |

| V000000037 | Navia Benefit Solutions | H0070797 | 8/10/2023 | 4,916.19 |

| V000000043 | Higher Education Retirement Plan | H0070799 | 8/10/2023 | 779.07 |

| V000000056 | Dependent Care Assistance | H0070802 | 8/10/2023 | 460.33 |

| V000000058 | DRS - PERS III WSIB | H0070803 | 8/10/2023 | 18,895.86 |

| V000000069 | WA ST Dept of Labor and Industries | H0070804 | 8/10/2023 | 5,229.73 |

| V000000070 | Chapter 13 Trustee | H0070789 | 8/10/2023 | 1,330.96 |

| V000041277 | Internal Revenue Service* | H0068589 | 7/25/2023 | 11,550.88 |

| V000041277 | Internal Revenue Service* | H0069866 | 8/10/2023 | 255,666.50 |

* The vouchers marked with an asterisk (*) are typically paid outside of ctcLink and should be marked manually paid.

40.90.50.6 Payroll Liabilities Payment Dates

Original vouchers should be posted without changes to allow for easier reconciliation between HCM and FIN. If changes are required two options are available:

- Create a new voucher to modify the payment amount.

- Create a Journal Voucher to modify the distribution lines.

Colleges should utilize Selective Payment Update to:

- Add comments to the payment remittance

- Change payment dates

- Split payments

See Reconciliation of Payroll Liability Accounts presentation for additional guidance.

40.90.50.7 Annuity and Retirement Plans 6% Maximum Process

As of July 1, 2011 the Legislature limited (RCW 28B.10.423(2)) community and technical college contribution from state funds to annuity and retirement income plans (e.g. SBRP(TIAA), 403b or 457b plans) to no more than 6% of salary.

When payroll is processed in HCM, the full amount of non-DRS retirement contributions will be computed (based on age or on employment agreement) and charged to the fund(s) the employee’s salary is distributed. Current state law requires any amount more than 6% of salary charged to a state fund must be moved to a local fund (149 Tuition or other local fund) after payroll processes.

The current State Board Retirement Plan (SBRP – often referred to a TIAA-CREF) has college contribution rates of 5, 7.5 or 10% based on employee age. The rule also applies to any other annuity or retirement plans like a 403b or 457b. If a college charges employee benefit contributions for these employees to state funds (001, 08A, 24J, 057, etc.) any college matching amount exceeding 6% must be paid out of local funds (Fund 149, 148, 145, etc.).

Three queries are built for this process:

1. QHC_PY_GROSS_TIAA_BENE_OVER_6

This query pulls detailed information on employees that have non-DRS retirement contributions greater than 6% of gross pay in a state fund when payroll processed. If an employee has multiple retirement plans, or if salary expenses are charged to multiple chartstrings, some values may be duplicated. However, the values ‘Over Amount Move to CF 149’ are not duplicated and are accurate.

2. QHC_PY_STATE_TIAA_JRNL_OVER_6

This query displays the journal lines and amounts needing to be moved out of state fund chart strings into local fund chart strings by Employee ID and by pay end date.

| Column Title | Debit | Credit | Debit | Credit |

|---|---|---|---|---|

| GL Unit | WAnnn | WAnnn | WAnnn | WAnnn |

| Pay Period End | 12/15/2024 | 12/15/2024 | 12/15/2024 | 12/15/2024 |

| ID | nnnnnnnnn | nnnnnnnnn | nnnnnnnnn | nnnnnnnnn |

| Account | 1000199 | 5010030 | 5010030 | 1000199 |

| Dept ID | 26001 | 26001 | 26001 | 26001 |

| PC Bus Unit | ||||

| Project | ||||

| Approp | 101 | 101 | ||

| Fund | 001 | 001 | 149 | 149 |

| Program | ||||

| Class | 018 | 018 | 018 | 018 |

| Oper Unit | 7nnn | 7nnn | 7nnn | 7nnn |

| Sub Acct | ||||

| State Purpose | N | N | N | N |

| Fund Affil | ||||

| Activity | ||||

| Earnings | 1,713.58 | 1,713.58 | 1,713.58 | 1,713.58 |

| 6% Max Deduct Amt | 102.81 | 102.81 | 102.81 | 102.81 |

| Ded Amt Taken | 171.36 | 171.36 | 171.36 | 171.36 |

| Adjustment Amount | 68.54 | (68.54) | 68.54 | (68.54) |

NOTE: This query should be run in Scheduled mode.

3. QHC_PY_STATE_TIAA_JRNL_6_TMPLT

For each pay period, the college should run this query which generates a file with all the debits and credits necessary to move the excess retirement contributions from state funds to local Fund 149 in a format used in the journal upload process.

The query will return the following results for each chartstring (the columns/rows have been transposed to fit the page).

| Column Title | Debit | Credit | Debit | Credit |

|---|---|---|---|---|

| GL Unit | WAnnn | WAnnn | WAnnn | WAnnn |

| Account | 1000199 | 5010030 | 5010030 | 1000199 |

| Dept ID | 26001 | 26001 | 26001 | 26001 |

| PC Bus Unit | ||||

| Project | ||||

| Approp | 101 | 101 | ||

| Fund | 001 | 001 | 149 | 149 |

| Program | ||||

| Class | 018 | 018 | 018 | 018 |

| Oper Unit | 7nnn | 7nnn | 7nnn | 7nnn |

| Sub Acct | ||||

| State Purpose | N | N | N | N |

| Fund Affil | ||||

| Activity | ||||

| Sum Amount | 68.54 | (68.54) | 68.54 | (68.54) |

NOTE: This query should be run in Scheduled mode.

Colleges should run these queries after each pay period’s activity posts to the General Ledger. Always run and upload each pay period separately.

The Excel spreadsheet generated from the ‘QHC_PY_STATE_TIAA_JRNL_6_TMPLT’ should be uploaded as an external journal the process described in the ctcLink Reference Center.

Uploading this journal will impact the amounts in the State Reimbursement(VPA) amount since expenditures are being moved from state funds to local funds.

To keep this process simple, all excess retirements are moved from state funds to Fund 149 since expenditures allowed in state funds are also permitted in Fund 149. However, it may be necessary to move some expenditures/internal cash from Fund 149 to other funds (e.g. capital funds from Fund 057 or 060 to other local funds).

The community and technical college system is required to report staff months to the state since OFM and legislative staff use the values to estimate number of total full-time equivalent employees (FTE) in our system in state and operating funds.

40.90.60.1 Staff Months Overview

A standard staff month (SMO) is equal to 174 hours (the average available work hours in a month). A staff month calculation is the percentage of time an employee works relative to the standard staff month. However, the calculations for certain types of employees is different and are described below.

Staff months are calculated in HCM using a custom process (E-192/E-193) as part of payroll processing. Staff months are calculated for each account code and earnings type combination. Staff months are not calculated for volunteer hours or when earnings do not add to total gross pay.

40.90.60.2 Staff Months in the General Ledger

Staff months calculated by HCM are recorded in the ledger as a Statistical value SMO. Statistical field SMO should be excluded when running queries or reviewing journals for monetary values.

40.90.60.3 Excluding Staff Months in Expenditure Queries

Staff months calculated by HCM are recorded in the ledger as a Statistical value SMO. Statistical field SMO should be excluded when running queries or reviewing journals for monetary values.

40.90.70.1 Payroll Corrections

Payroll corrections are processed in the general ledger and include the entire chartstring for salary and benefit costs including the staff months (SMO) associated with the correction of the employee(s) payroll record. The HCM-Payroll records for the employee or group of employees will not change once payroll has been processed.

Colleges are strongly encouraged to maintain good documentation for tracking purposes and for reconciliation between payroll records in HCM and FIN.

Payroll corrections use account codes 5000xxx (salaries) and 5010xxx (benefits) for the expense portion with internal cash to balance the transactions. The SMO should be entered on the appropriate 5000xxx line in the “STAT” field.

40.90.70.2 Combo Code Error Corrections

As noted in CLAM 40.90.20.3 invalid combo codes will process in HCM payroll but will error out in FIN based upon the combination edit rules (See CLAM 10.40).

When an invalid combo code is used all accounting entries (benefit expenses and liabilities) for the employee are recorded in Fund 790, Class 301, (department based on college configuration) and the employee’s salary expense account is changed to 5010170 - Payroll Suspense. Colleges should go through the following process each pay period to ensure all combo codes are valid and to correct all errors:

1 . Identify the Employees.

Each pay period run a query like this one:

Using the current pay period end date and including Fund 790. This will identify the employee(s) with invalid Combo Codes and provide the accounting lines that must be corrected.

2. Identify the Invalid Combo Code.

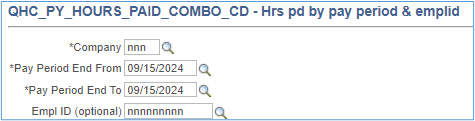

Running this query for each Empl ID will provide the Combo Code used that caused the error:

3. Correct the Combo Code causing the error.

If the combo code is inactive but is a valid chartstring, it is possible to activate the code. If the chartstring is not valid, either a different code will need to be assigned to the employee or a new combo code created and then assigned. Follow the steps identified in CLAM Section 40.90.10 using the Find an Existing Value to look up the Combo Code:

4. Correct the Accounting Entries.

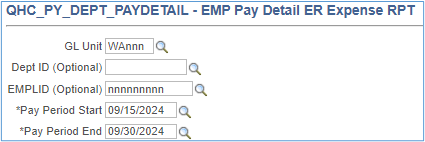

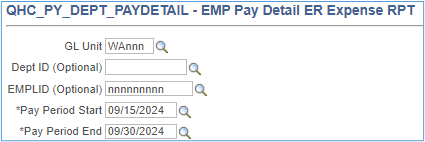

The query ‘QHC_PY_DEPT_PAYDETAIL’ in HCM will provide all the expenditure accounting detail necessary to create the journal entry.

| Jrnl Src | Fund | Class | Accounts | Debit | Credit |

| PTR | 790 | 301 | Internal Cash | 100199 | |

| 790 | 301 | Payroll Suspense | 5010170 | ||

| 790 | 301 | Benefit Expense | 5010nnn | ||

| nnn | nnn | Salary Expense | 5000nnn | ||

| nnn | nnn | Benefit Expense | 5010nnn | ||

| nnn | nnn | Internal Cash | 100199 |

Since the Net Pay Liability will be relieved using the Voucher Upload Process and other payroll liabilities will be relieved using the Voucher Build Process it is critical the journal only moves the expenses from the Fund 790 chartstring to the correct chartstring. If the correct chartstring uses a state fund (001, 24J, etc) the VPA process will pick up those expenses and the college will receive reimbursement from the State Treasurer.

40.90.70.3 Payroll Transfers

Intra-agency transfers are used to reclassify expenditures within the district between funds, appropriation indexes, etc. In Legacy, these transactions were commonly referred to as “T-transfers”.

The practice of transferring large monetary amounts between accounts (“T-Transfers”), primarily to cover employee compensation costs, has created transparency, accountability, and funding questions from oversight agencies.

In addition, because salary expenditure amounts are used to allocate salary increase funding, concerns about colleges “gaming” the allocation system by charging more to state funds than the college actually spends by year-end close due to transfers.

Each ‘T’ transfer will have to identify an account code to differentiate how the transferred funds are being used (classified, exempt, faculty, other (for tech colleges) and student employees). Differentiating between account codes slightly increases the workload for community and technical colleges but it meets the needs of state legislators.

Colleges MUST enter the number of staff months as an additional data point. Colleges are expected to consistently use the Fund, Appropriation Index, Class and State Purpose. Since Department (Org Index) and specific grant information is not sent to AFRS, colleges may use a single Department for salary and benefit transfers if they choose to do so.

Intra-agency transfers use account codes 5081010 through 5081080. DO NOT include any SMO data on intra-agency salary transfers (5081010). When SMO data is attached to the 5081010 account, it creates AFRS reporting errors resulting in the deletion of the data.

Do not report staff months for Fund 790 or 840 as these are prohibited by state accounting rules.

Include SMO data on only the salaries and wages expenditure line of the journal. Do not include SMO for any other accounts.

When transferring salary expenditures within ctcLink the following fields are always required or have special requirements. See legend (1-6) below.

| FIELD | VALUE |

|---|---|

| Unit | Required |

| Account | (1) |

| Oper Unit | Required |

| Fund | (2) |

| Dept | (3) |

| Class | (4) |

| Approp Index | Required |

| Project | (5) |

| State Purpose | Required |

| Amount | $0.00 |

| Stat | SMO |

| Stat Amt | (6) |

(1) Accounts

When transferring salary expenditures only the following five (5) accounts may be used (colleges are always welcome to reverse the original account and record the correct account):

| TRANSFER ACCOUNT | DESCRIPTION |

|---|---|

| 5081012 | All employees/positions which have been defined as exempt by chapter 41.06 RCW, by the Washington Personnel Resources Board and by the governing board of the institution excluding faculty, graduate assistants, students, and higher education other |

| 5081014 | All employees/positions whose primary responsibilities are teaching, research, public service, or a combination of these, including librarians and counselors designated as faculty. |

| 5081016 | All classified employees/positions under the jurisdiction of the Washington Personnel Resources Board. |

| 5081018 | All student employees other than graduate assistants or those covered by Washington Personnel Resources Board, including work-study students. |

| 5081019 | All employees/positions not subject to other classifications. |

Salary Expenditure Types & Transfer Accounts

| ACCOUNT | DESCRIPTION | TRANSFER ACCOUNT |

|---|---|---|

| 5000010 | Exempt Executive | 5081012 |

| 5000020 | Exempt Managerial | 5081012 |

| 5000030 | Exempt Professional/Technical | 5081012 |

| 5000040 | Exempt Support Staff | 5081012 |

| 5000050 | Exempt Temporary | 5081012 |

| 5000110 | Classified PT Hourly (Non-Rep) | 5081012 |

| 5000060 | Faculty Permanent FT | 5081014 |

| 5000070 | Faculty Permanent PT | 5081014 |

| 5000080 | Faculty Temporary FT | 5081014 |

| 5000090 | Faculty Temporary PT | 5081014 |

| 5000100 | Community College Classified | 5081016 |

| 5000120 | Technical College Classified | 5081016 |

| 5000130 | Higher Education Students | 5081018 |

| 5000140 | Work Study Students | 5081018 |

| 5000180 | Higher Education Other | 5081019 |

| 5000190 | Technical College Classified PT Hrly | 5081019 |

(2) Fund

DO NOT record staff months for either Fund 790 or 840. The entries will be rejected, and the college will be asked to correct the entries.

(3) Department

Colleges may use a single department for all transfers since Department is not included in our transmittal to AFRS.

(4) Class Code

Colleges may group transfers by Class Code (Program Index). i.e. 011, 012, 014, 016, 018 may be transferred by any class 01x, any 061, 062 etc. may be transferred by any 06x. College data is transferred to AFRS using 010, 040, 050, etc. therefore the specific Class/PI is not significant in AFRS (for colleges it is important due to IPEDS reporting).

(5) Projects

PC Bus Unit/Project/Activity/Analysis Type are always required for project costs.

(6) Staff Months

Every transfer of salary expenditures requires staff months as well. Enter SMO in the ‘Stat’ field and the totally number of staff months in the ‘Stat Amt’ field.

DO NOT enter staff month in lines with asset, liability, revenue or equity accounts!

DO enter staff months in journals only with salaries and wages accounts (5000010 through 5000190 and 5081012 through 5081019)!

40.90.70.4 Calculating Staff Months for Transfers

Staff month calculations in HCM vary depending on the employee type (e.g. faculty, administrative), employee payment type (e.g. salaried, hourly, contract). For the purposes of transfers, colleges should simply prorate the staff months based on the proration of the salary transfers. If an employee was charged 100% to a single fund and 50% of the salary costs are being transferred to another fund, 50% of the staff months should be transferred as well.

40.90.80.1 Shared Leave Laws and Rules

State law allows a state employee to come to the aid of another state employee who is likely to take leave without pay or terminate his or her employment because the employee suffers from, or has a relative or household member suffering from, an illness, injury, impairment, or physical or mental condition which is of an extraordinary severe nature; is a victim of domestic violence, sexual assault or stalking; needs the time for parental leave; or they employee is sick or temporarily disabled because of pregnancy disability.

Certain current or former members of uniformed services may also be eligible for donated shared leave.

Donating employees must maintain at least 40 hours of annual leave and 176 hours of sick leave after donation.

Donating employees who only receive sick leave, must maintain at least 22 days of sick leave after donation.

40.90.80.1.a Shared Leave Use

Colleges/state agencies must track shared leave used over the state career of the recipient employee (donee). Employees may receive no more than 522 days of shared leave for their entire state employment (tracking normally an HR function).

Employees who have received shared leave must use all compensatory time, recognition leave, and personal holiday leave they have accrued before using shared leave.

Exception: Employees may retain 40 hours of vacation leave as well as 40 hours of sick leave in reserve while using shared leave.

40.90.80.1.b College Participation

Colleges should develop policies and procedures to establish the college’s participation in the shared leave program. For example, some colleges only allowed shared leave within the college.

40.90.80.2 Shared Leave Calculations

40.90.80.2.a Donor Calculations

When a college employee donates shared leave, the college must calculate the full value of the hours donated, including benefits (total salary rate). Some colleges include the leave accrual benefit rate in the total salary rate.

Calculate the dollar value of donated leave using the donor’s total current total salary rate times the hours donated.

In transferring leave from the donor to the donee, it is the donor’s dollar value of the leave that transfers and purchases shared leave for the donee at the donee’s total salary rate.

40.90.80.2.b Recipient (Donee) Calculations

When a college employee receives shared leave, the college must calculate the full hourly cost including benefits (total salary rate) of the donee. Some colleges include the leave accrual benefit rate in the total salary rate.

In transferring leave from the donor to the donee, it is the donor’s dollar value of the leave that transfers and purchases shared leave for the donee at the donee’s total salary rate.

Calculate the dollar value of donated leave using the donor’s total current total salary rate times the hours donated.

For the donee, divide the dollar value received by the donee’s total current salary rate to determine the leave hours to record.

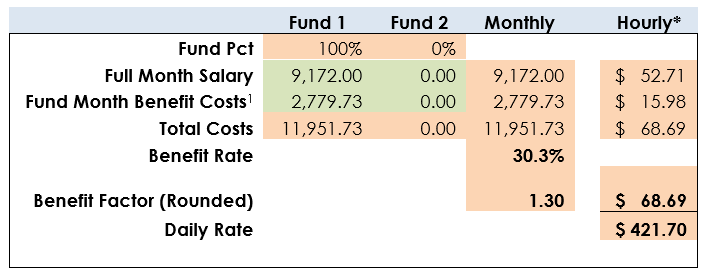

40.90.80.2.c Total Salary Rate Calculations

For an example and template for calculating and tracking leave used see the Shared Leave Workbook (add link).

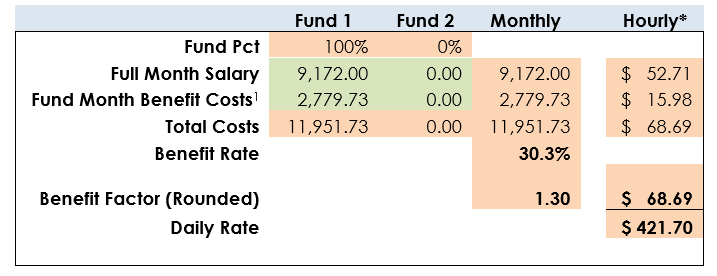

Calculate Total Salary Benefit Rate

Determine most recent full monthly salary rate (all accounts 5000010 - 5000120 and 5000180 - 5000190 for donating employee).

Determine most recent monthly benefit costs (all accounts beginning 501 for donating employee):

1 Use of full-month benefits is necessary since health benefits are paid only once each month.

Complex alternative-text: Calculate Total Salary Benefit Rate

| ITEM | FUND 1 | FUND 2 | MONTHLY | HOURLY* |

|---|---|---|---|---|

| Fund Pct | 100% | 0% | ||

| Full Month Salary | $ 9,172.00 | 0.00 | 9,172.00 | $ 52.71 |

| Fund Month Benefit Costs1 | $ 2,779.73 | 0.00 | 2,779.73 | $ 15.98 |

| Total Costs | $11,951.73 | 0.00 | 11,951.73 | $ 68.69 |

| Benefit Rate | 30.3% | |||

| Benefit Factor (Rounded) | 1.30 | $ 68.69 | ||

| Daily Rate | $ 421.70 |

1 Use of full-month benefits is necessary since health benefits are paid only once each month.

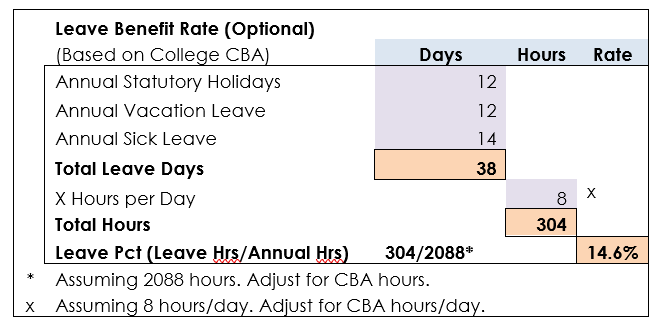

Leave Benefit Rate (Optional, based on College CBA)

Not all agencies and colleges include leave benefits in the benefit rate calculation; however:

- Determine the number of holidays, sick leave, and vacation leave days an employee could potentially earn while on shared leave and convert to hours.

- Divide the hours determined above by the annual hours worked. The state of Washington defines an FTE as 2088 hours. College collective bargaining agreements may use different hours to define an FTE.

Complex alternative text: Calculate Leave Benefit Rate (Optional, based on College CBA)

| ITEM | Days | Hours | Rate |

|---|---|---|---|

| Annual Statutory Holidays | 12 | ||

| Annual Vacation Leave | 12 | ||

| Annual Sick Leave | 14 | ||

| Total Leave Days | 38 | ||

| X** Hours per Day | 8 | x | |

| Total Hours | 304 | ||

| Leave Pct (Leave Hrs/Annual Hrs) | 304/2088* | 14.6% |

* Assuming 2088 hours. Adjust for CBA hours.

**X Assuming 8 hours per day. Adjust for CBA hours/day.

Total Benefit Rate (including leave)

| Type | Rate |

|---|---|

| Benefit Rate | 30.3% |

| Leave Benefit Rate | 14.6% |

| Combined Rate | 45% |

| Combined Benefit Factor | 1.45 |

40.90.80.2.d Total Salary Rate

To determine the total salary rate for both donor and done, multiply the hourly rate times the benefit factor (choose regular benefit factor or full benefit, depending on college policy).

The total salary rate can also be calculated by dividing the total monthly cost (salary and benefits) by the standard monthly hours.

In this example, multiplying $52.71 times 1.30 results in a full salary rate of $68.69. The same result can be achieved by dividing full monthly costs ($11,951.73) by the standard hours worked in a month (174).

Calculate Total Salary Rate

Complex alternative text: Calculate Total Salary Rate

| ITEM | FUND 1 | FUND 2 | MONTHLY | HOURLY |

|---|---|---|---|---|

| Fund Pct | 100% | 0% | ||

| Salary | 9,172.00 | 0.00 | 9,172.00 | $ 52.71 |

| Benefit Costs | 2,779.73 | 0.00 | 2,779.73 | $ 15.98 |

| Total Costs | 11,951.73 | 0.00 | 11,951.73 | $ 68.69 |

| Benefit Rate | 30.3% | |||

| Benefit Factor | 1.30 | $ 68.69 | ||

| Daily Rate | $ 421.70 |

40.90.80.2.e Value of Donated Leave

In transferring leave from the donor to the donee, it is the donor’s dollar value of the leave that transfers and purchases shared leave at the donee’s salary rate.

Calculate the dollar value of donated leave using the donor’s total current salary rate times the hours donated.

Calculating Value of Leave Donated by Employee (Donor)

|

ITEM |

VALUE |

|

Sick Leave Hours Donated |

8.00 |

|

Vacation Leave Hours Donated |

4.00 |

|

Total Hours Donated |

12.00 |

|

x Hourly Rate (with benefits) |

$ 68.69 |

|

Value of Shared Leave |

$ 824.26 |

40.90.80.2.f Donee Leave Purchased

When transferring leave from the donor to the donee, it is the donor’s dollar value of the leave that is transferred and purchases shared leave for the donee at the donee’s salary/benefit rate.

Calculating Hours of Donated Leave for Receiving Employee (Donee)

| ITEM | VALUE |

|---|---|

| Value of Shared Leave | $ 824.26 |

| Hourly Rate (with benefits) | $ 35.08 |

| Shared Leave Hours Received | 23.50 |

40.90.80.3 Within College as Used

The donee’s pay period salary is recorded as usual in HCM, debiting expenses and crediting liabilities. When payment is made, the liabilities are debited and cash is credited.

To reflect the use of shared, the following entry should be made for total payroll costs (salary and benefits) in the donee’s full chartstring(s):

- Debit 1000199 Internal Cash

- Credit 5010130 Shared Leave Received

In the donor’s chartstring the following entries should be made:

Debit 5010100 Shared Leave Donated – SL

5010110 or Shared Leave Donated – PH

5010120 or Shared Leave Donated – AL

Credit 1000199 Internal Cash

40.90.80.4 Within College as Received

40.90.80.4.a Recording Receipt of Shared Leave Funds

In the donor’s chartstring the following entries should be made for the full value of the donation:

Debit 5010100 Shared Leave Donated – SL

5010110 or Shared Leave Donated – PH

5010120 or Shared Leave Donated – AL

Credit 1000199 Internal Cash

In 790-285-98439 the following entry (equal to the above entry) should be recorded:

Debit 1000199 Internal Cash

Credit 5081020 Intra Agency Transfer Benefits

40.90.80.4.b Recording Use of Shared Leave Funds

The donee’s pay period salary is recorded as usual in HCM, debiting expenses and crediting liabilities. When payment is made, the liabilities are debited, and cash is credited.

To reflect the use of shared, the following entry should be made for total payroll costs (salary and benefits) in the donee’s full chartstring(s):

Debit 1000199 Internal Cash

Credit 5010130 Shared Leave Received

And in 790-285-98439 the following entry (equal to the above entry) should be recorded:

Debit 5081020 Intra Agency Transfer Benefits

Credit 1000199 Internal Cash

40.90.80.4.c Returning Unused Shared Leave Funds within College

When not all shared leave is needed, the balance should be returned to the donor. To return the following entries should be recorded:

To reflect the use of shared leave, the following entry should be made for total payroll costs (salary and benefits) in the donee’s full chartstring(s):

Since the original receipt of shared leave funds were recorded in 790-285-98439 and dispersed to the donee’s chartstring, the following entry should be recorded to return the funds:

Debit 5081020 Intra Agency Transfer Benefits

Credit 1000199 Internal Cash

40.90.80.5 Shared Leave Between Colleges/Agencies

40.90.80.5.a Recording Payment of Shared Leave Funds

If a college employee donates shared leave to another college or agency, the following entries should be recorded in the donor’s chartstring(s) for the full value of the donation:

Debit 5010100 Shared Leave Donated – SL

5010110 or Shared Leave Donated – PH

5010120 or Shared Leave Donated – AL

Credit 1000070 Cash in Bank

40.90.80.5.b Recording Shared Leave As Received

The receiving college should record the following entry in 790-285-98439:

Debit 1000070 Cash in Bank

Credit 5010130 Shared Leave Received

40.90.80.5.c Recording Use of Shared Leave Funds

The donee’s pay period salary is recorded as usual in HCM, debiting expenses and crediting liabilities. When payment is made, the liabilities are debited, and cash is credited.

To reflect the use of shared leave, the following entry should be made for total payroll costs (salary and benefits) in the donee’s full chartstring(s):

Debit 1000199 Internal Cash

Credit 5010130 Shared Leave Received

And in 790-285-98439 the following entry (equal to the above entry) should be recorded:

Debit 5010130 Shared Leave Received

Credit 1000199 Internal Cash

40.90.80.5.d Returning Unused Shared Leave Funds

When not all shared leave is needed, the balance should be returned to the donor. To return the following entries should be recorded:

To reflect the use of shared leave, the following entry should be made for total payroll costs (salary and benefits) in the donee’s full chartstring(s):

Since the original receipt of shared leave funds were recorded in 790-285-98439 and dispersed to the donee’s chartstring, the following entry should be recorded to return the funds:

Debit 5010130 Shared Leave Received

Credit 1000070 Cash in Bank

When a college employee is laid off or loses their job through no fault of their own, they may qualify for unemployment insurance benefits. When a qualifying employee is laid off and establishes eligibility, they receive monthly unemployment compensation (UC) benefits. On a quarterly basis, the college receives a bill from the Employment Security Department (ESD) for the actual UC benefit paid the former employee.

40.90.90.1 Reimbursable Unemployment Compensation

A college (as a state agency) is exempt from Federal Unemployment Tax Act (FUTA) and therefore is required to use the reimbursable method of paying UC. Taxable employers pay a percentage of the taxable wages to ESD each year and exempt agencies do not.

Each college must submit quarterly reports just like taxable employers. However, no payments are made with the reports. Instead, colleges are billed for their share of benefits paid to former employees even if the employee voluntarily left the college for other employment and was subsequently terminated from that position.

40.90.90.2 College Unemployment Compensation Funding Options

Two primary methods exist for paying UC when billed by ESD.

- Direct Pay is a simpler process that records the unemployment charge in the chartstring where the former employee's salary and benefits were charged. However, the drawback to this option is that frequently the charges for unemployment benefits arise after a program has been closed and no funding is available in the original chartstring to cover the charges. In these circumstances, the only option left to colleges is to fund those charges from local unrestricted funds.

- Pooled Unemployment Reserve has the advantage of spreading the cost for unemployment benefits over all chartstrings and no single chartstring is adversely impacted by large, unanticipated UC benefit charges. The disadvantage is that the process carries a higher administrative burden.

40.90.90.3 Using Direct Pay by Invoice

The first step is to determine the chartstrings(s) the employee was salary was charged to while employed (using a specified period – prior year, prior two years, etc). The payment to ESD should then be split between all chartstrings based on prior salary charges. If the chartstring is no longer available, the charges should be paid out of the original fund.

Remember, state funds are not allowed to pay unemployment charges for employees originally funded by self-support, grants, internal service and proprietary funds. However, local unrestricted funds (LUF) are allowed to pay unemployment charges for employees originally funded by state or local funds.

If an unemployment liability has not been created, the voucher should be recorded using account 5010080 - Unemployment Compensation (in a debit/positive position since the Voucher system will automatically record a credit to the AP Control liability account 2000010).

| Emp | Fund Code (Salary Chartstring) |

AI (Salary Chartstring) |

Class (Salary Chartstring) |

Dept ID (Voucher Coding) |

Pct (Voucher Coding) |

Eligible Funds (Voucher Coding) |

Exp Account (Voucher Coding) |

|---|---|---|---|---|---|---|---|

| Emp #1 | 145 | 083 | 50000 | 100% | 145, 146 | 5010080 | |

| Emp #2 | 001 | 101 | 011 | 42572 | 50% | 001, 149, LUF* | 5010080 |

| Emp #2 | 149 | 011 | 42572 | 50% | 001, 149, LUF* | 5010080 | |

| Emp #3 | 524 | 261 | 43581 | 100% | 524 | 5010080 | |

| Emp #4 | 148 | 014 | 33245 | 100% | 148, LUF* | 5010080 |

* Local Unrestricted Funds

40.90.90.4 Creating the Unemployment Compensation Pool

40.90.90.4.a Establishing the Unemployment Compensation Rate

Creating an Unemployment Pool requires the college to establish a rate or rates that is (are) applied to the wages paid to all employees or groups of employees (i.e. Exempt, Faculty, Classified). The charge is recorded as a benefit expense for each employee during the payroll process and the money is deposited into a reserve account from which the quarterly claims are paid.

The percentage required to cover a college's quarterly unemployment charges is determined by analyzing the total payroll for the past one or more years in comparison to the actual unemployment charges for those same periods.

UC Reserve rate is the percentage of total unemployment charges to total salary and wages. For example, if the total wages paid for the past year were $56,098,787 and the total UC charges for the same period were $321,071, the UC reserve rate for the following year would be:

| UC Paid | Total Salary | Pct | ||

|---|---|---|---|---|

| $321,071 | ÷ | $56,098,787 | = | 0.573% |

For FY2024 the system-wide unemployment rate was .549%, ranging between .212% and 1.406% generally with higher rates in urban areas.

The percentage or rate must be reviewed annually and must be adjusted to reflect the most recent data and for anticipated terminations or layoffs.

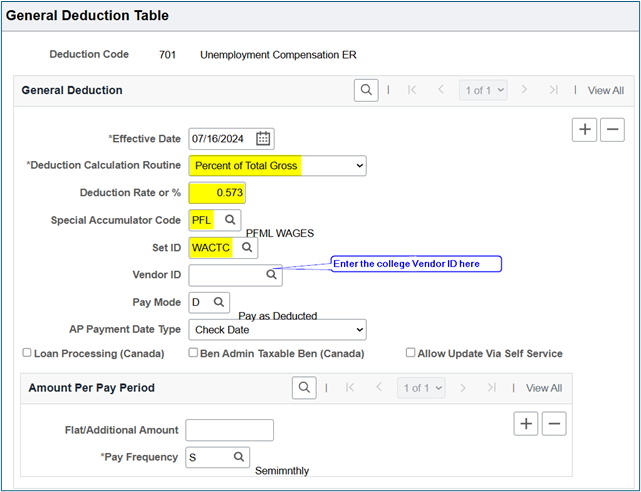

40.90.90.4.b Configuring the HCM Deduction Tables

General Deduction Table

This percentage is used in HCM to configure the Unemployment Compensation ER page (may require working with payroll staff since permissions are required): HCM > Menu > Set Up HCM > Product Related > Payroll for North America > Deductions > General Deduction Table. The page should be configured like this assuming the rate calculated above:

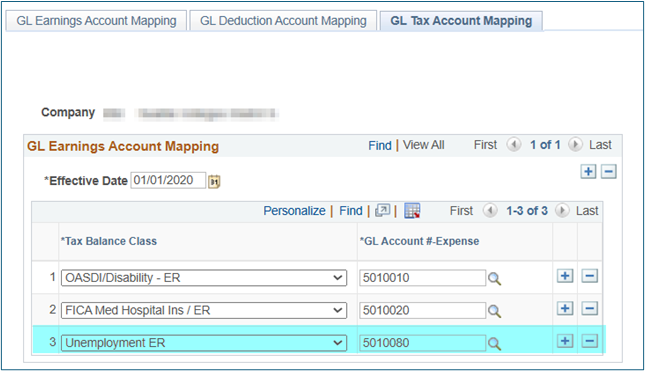

The GL Account Mapping tables determine the account that will be used for the deduction (permissions required): Menu > Set Up HCM > CTC Custom > CTC GL Account Mapping > GL Tax Account Mapping or GL Deduction Account Mapping.

GL Tax Account Mapping Table

GL Deduction Account Mapping Table

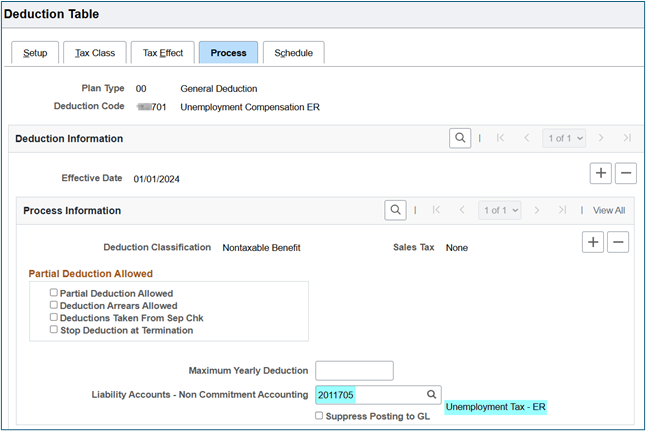

Deduction Table – Process Tab

The associated liability account is configured here: Menu > Set Up HCM > Product Related > Payroll for North America > Deductions > Deduction Table and select Process.

Since UC is only paid by the college the liability should be configured using 20110705 – Unemployment Tax - ER.

40.90.90.5 Recording Unemployment Compensation Entries

When payroll processes, HCM records both the Unemployment Compensation - ER expense and the Unemployment Tax - ER liability amounts in the PAY journal.

In a simplified format, the payroll journals will generate the expense and liability entries.

| Fund | AI | Class | Dept | Acct | Amt | Desc |

|---|---|---|---|---|---|---|

| fff | aaa | ccc | ddddd | 5000xxx | $136.16 | Salary Exp |

| fff | aaa | ccc | ddddd | 5010085 | 0.88 | UC Exp |

| fff | aaa | ccc | ddddd | 501xxxx | 2.87 | Other Ben Exp |

| fff | aaa | ccc | ddddd | 2011015 | $(133.61) | Net Pay |

| fff | aaa | ccc | ddddd | 2011705 | (0.88) | Unemp Tax - ER |

| fff | aaa | ccc | ddddd | 2011xxx | (5.42) | Other Liability |

The liability accruals (payable to the college) are sent to the voucher system where the original liability is debited and a credit 2000010 - AP Control Liability is created.

| Fund | AI | Class | Dept | Acct | Amt | Desc |

|---|---|---|---|---|---|---|

| fff | aaa | ccc | ddddd | 2011705 | 0.88 | Unemp Tax - ER |

| fff | aaa | ccc | ddddd | 2000010 | (0.88) | AP Control |

When the payment is made, the AP Control liability is debited and Cash in Bank is credited.

| Fund | AI | Class | Dept | Acct | Amt | Desc |

|---|---|---|---|---|---|---|

| fff | aaa | ccc | ddddd | 2000010 | 0.88 | AP Control |

| fff | aaa | ccc | ddddd | 1000070 | (0.88) | Cash In Bank |

These entries are repeated to each chartstring used in HCM for each employee chartstring (summarized for Payroll data in Finance).

However, since the payment was made to itself, the college must record the receipt of the funds in a single chartstring for all Unemployment Compensation payment chartstrings. This can be accomplished either of two ways:

1. Record a Departmental Receipt (Menu > Student Financials > Cashiering > Collect Departmental Receipts) using the following fixed chartstring:

| Fund | AI | Class | Dept | Acct | Amt | Desc |

|---|---|---|---|---|---|---|

| 148 | 082 | 98429 | 2011705 | 0.88 | Unemp Tax - ER |

The receipting system is designed to automatically record the amount as a credit and debit 1000070 Cash in Bank in the same chartstring.

2. Record an ARDJ (Menu > Accounts Receivable > Payments) using the following fixed chartstring:

| Fund | AI | Class | Dept | Acct | Amt | Desc |

|---|---|---|---|---|---|---|

| 148 | 082 | 98429 | 5010080 | (0.88) | Unemp Comp |

The amount received should be recorded as a credit to 5010080 - Unemployment Compensation and the system will debit 1000070 Cash in Bank in the same chartstring.

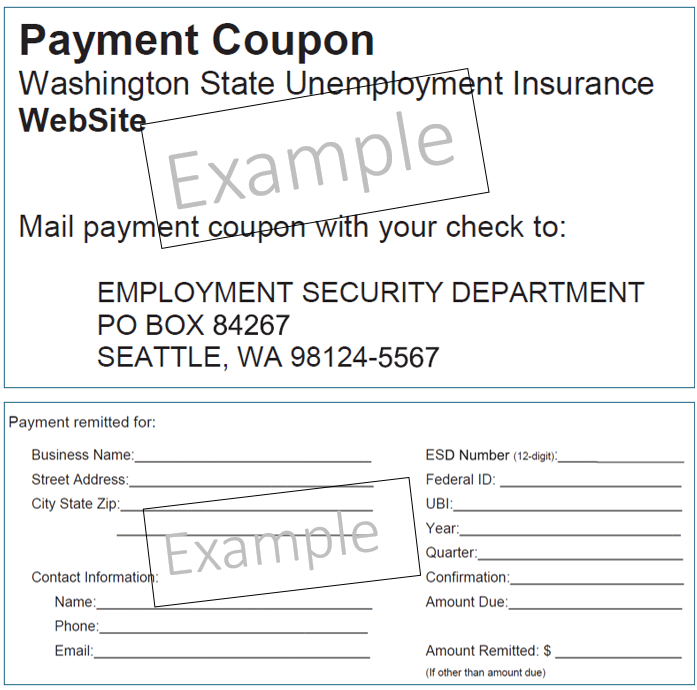

40.90.90.6 Paying Quarterly UC Invoice

Payments may be made either by:

- Logging into ESD’s Employer Account Management Services (EAMS) and transmitting funds electronically, or

- Sending a check with the required Payment Coupon available at the ESD website:

I

40.90.90.6.a Direct Pay

As noted above, the Employment Security Department will send the college an invoice for all unemployment compensation payments to former college employees in the previous quarter. Also noted earlier, if the college elects to use the Direct Pay method, expenditures should be charged to the chartstring used for the employee salaries and benefits during their employment. If the funding source no longer exists, the expenditures should be charged to uncommitted/unrestricted local funds.

40.90.90.6.b Employment Pool Payment

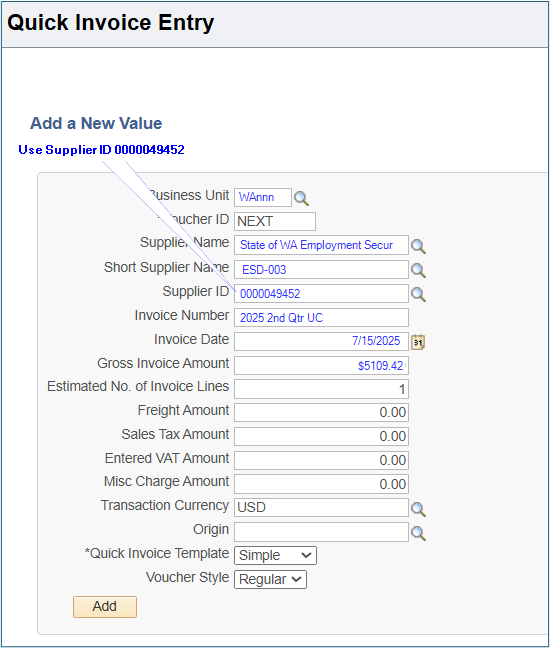

Since the UC payments processed in HCM were ultimately recorded in a single chartstring, paying the quarterly ESD invoice only requires recording the invoice in the voucher system and paying the invoice by logging into ESD’s Employer Account Management Services (EAMS).

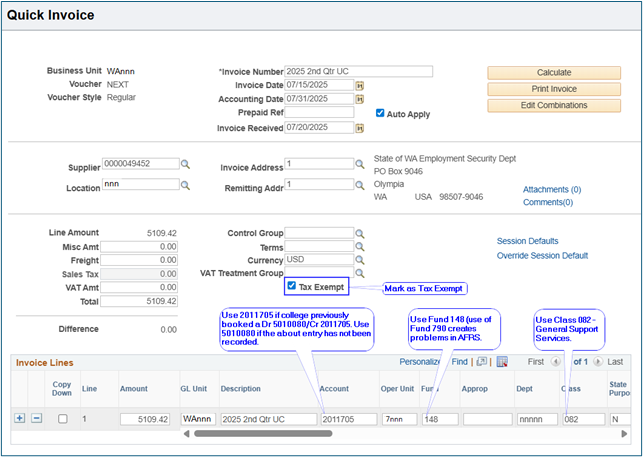

Quick Invoice

(Menu > Accounts Payable > Vouchers > Quick Invoice Entry)

Colleges should use Supplier 0000049452 - State of WA Employment Security Dept to initiate the payment. Complete Invoice Number (consider using a descriptive invoice number for easy reference), Invoice Date and Amount.

Quick Invoice Detail

Mark the invoice as Tax Exempt to ensure the system does not record Use Tax on the payment.

Account - If the college has previously recorded the Credit to liability 2011705 - Unemployment Tax – ER/Debit to expense 5010085 - Unemployment Tax Exp – ER then enter 2011705 in the Account field.

If the liability/expense has not been recorded, enter 5010085 - Unemployment Tax Exp – ER in the Account field. Whether you enter 2011705 or 5010085, the voucher system will automatically record a Credit to 2000010 – AP Control Liability as the offset.

When the payment is processed in ctcLink, the voucher system Debits 2000010 – AP Control Liability and Credits 1000070 – Cash in Bank.

| Jrnl ID | Vendor ID | Vchr ID | Descr | Fund | Class | Dept | Acct | Amount |

|---|---|---|---|---|---|---|---|---|

| ACCRUAL | V000000092 | 00020282 | Accts Payable | 148 | 082 | ddddd | 2000010 | (5,109.42) |

| ACCRUAL | V000000092 | 00020282 | UI Tax | 148 | 082 | ddddd | 2011705 | 5,109.42 |

| PAYMENT | V000000092 | 00020282 | Cash Distrib | 148 | 082 | ddddd | 1000070 | (5,109.42) |

| PAYMENT | V000000092 | 00020282 | Accts Payable | 148 | 082 | ddddd | 2000010 | 5,109.42 |

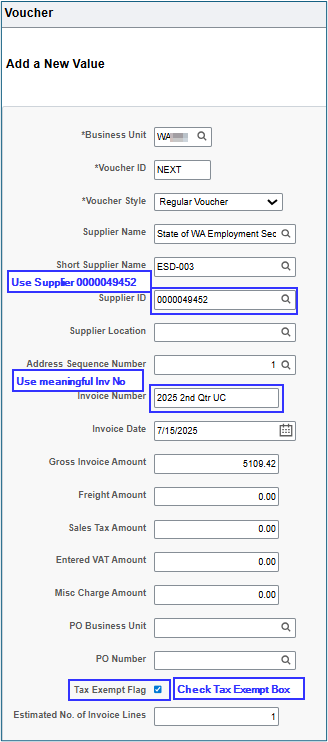

Regular Entry – Add New Value

(Menu > Accounts Payable > Vouchers > Regular Entry)

Colleges should use Vendor/Supplier ID 0000049452 when paying unemployment compensation invoices to ESD. The invoice number used should allow the college to easily identify the payment. The voucher should have the Tax Exempt box checked.

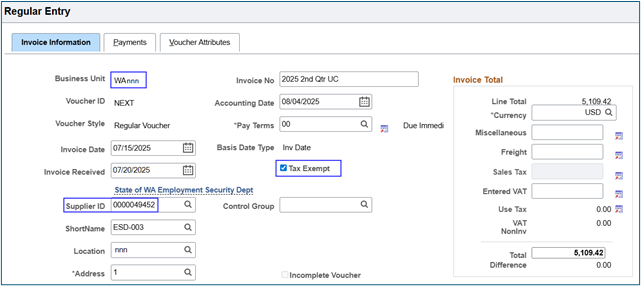

Invoice Information

This section is primarily information entered in the Add New Value noted above.

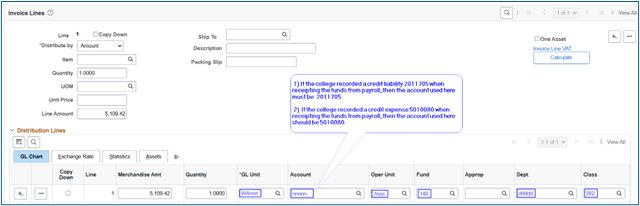

Invoice Lines

- If the college recorded a credit liability 2011705 when receiving the funds from payroll, then the account used here must be 2011705.

- If the college recorded a credit expense 5010080 when receiving the funds from payroll, then the account used here should be 5010080.

- The unemployment expense should be recorded in Fund 148, Class 082 and Department used Unemployment Compensation only.

40.70.40 Accounting for Capital Asset COPs << 40.90 >> 50 Student Financials