Building and Innovation Fee Remittance

Overview

Revised 2024-03-19

Building and Innovation Fee Remittance should only be processed after month-end close.

Tuition transactions from Student Financials (SF) are only recorded in Periods 1 to 12 unless a college records a manual entry for Building or Innovation.

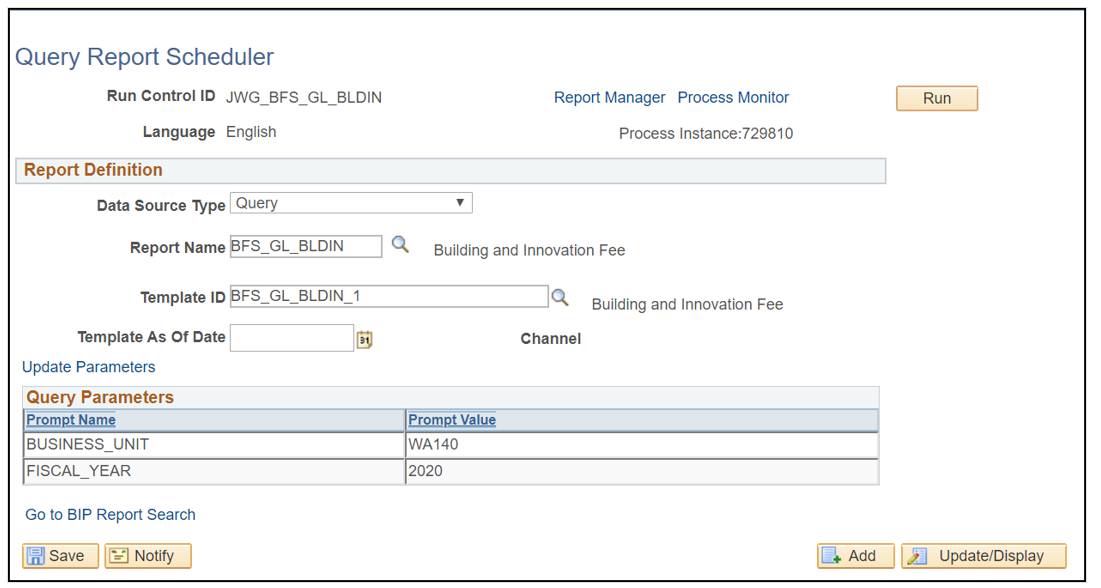

Run query to identify net cash collected for both Building (Z60) and Innovation Fee (Z61).

- You will need to create a Run Control for this report.

- Navigate to Reporting Tools > BI Publisher > Query Report Scheduler

See “Running a BI Publisher Report in Query Report Scheduler” in the ctcLink Report Catalog for more information.

Fig. 1 Query Report Scheduler

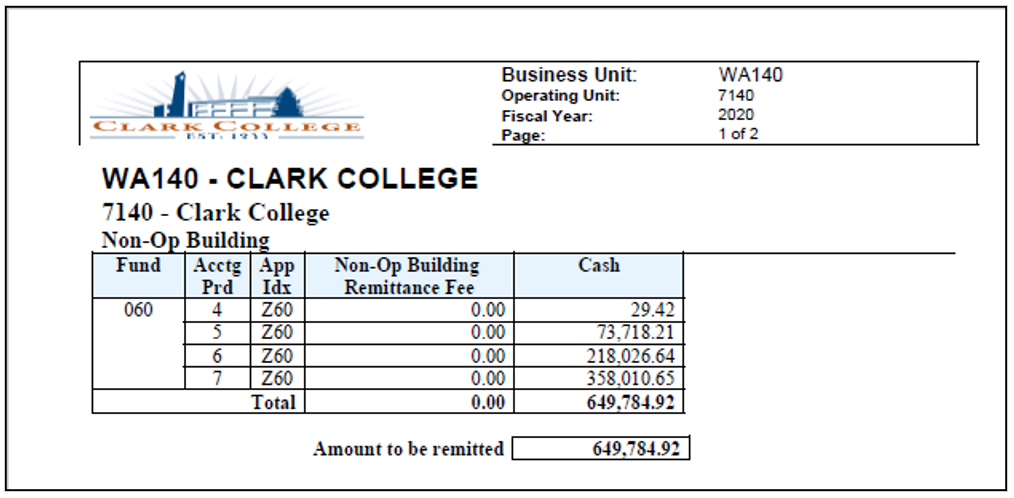

- Report page 1 shows Year-to-Date submissions and collections of Building Fee. Page 2 shows the YTD submissions and collections of Innovation Fee.

- Non-Op Building Remittance Fee shows YTD payments and Cash shows YTD collections.

- Amount to be remitted should be the net amount.

See “Finance Building and Innovation Fee Report” in the ctcLink Report Catalog for more information.

Fig. 2 Finance Building and Innovation Fee Report BFS_GL_BLDIN Example

- Supplier V000045380

- Expenditure Distribution

- Fund 790/Class 285/98499

- Debit 5120xxx/Credit 2000010

- 5120010 – Non-Op Building Fee Remittance Fund 060

- 5120020 – Non-Op Innov Fee Remittance Fund 561

See also ctcLink Accounting Manual 10.30.45.5 Expenditure/Expense Accounts:

- Tab: Account Classification: 5100000-5199999 Non-Operating Expenditures/Expenses

- Section: Reporting Class: 5120000-5129999 Remittances

SBCTC submits Treasury Journal Voucher to the State Treasurer listing each fund (060, 057, etc.) either via fax or email.

SBCTC submits a Treasury Journal Voucher to the State Treasurer on behalf of all colleges.

SBCTC draws Building and Innovation via ACH from each college, and then remits to the State Treasurer via ACH or Wire.

Record payment to Treasurer/Cash In Bank: Dr 2000010/Cr 1000070

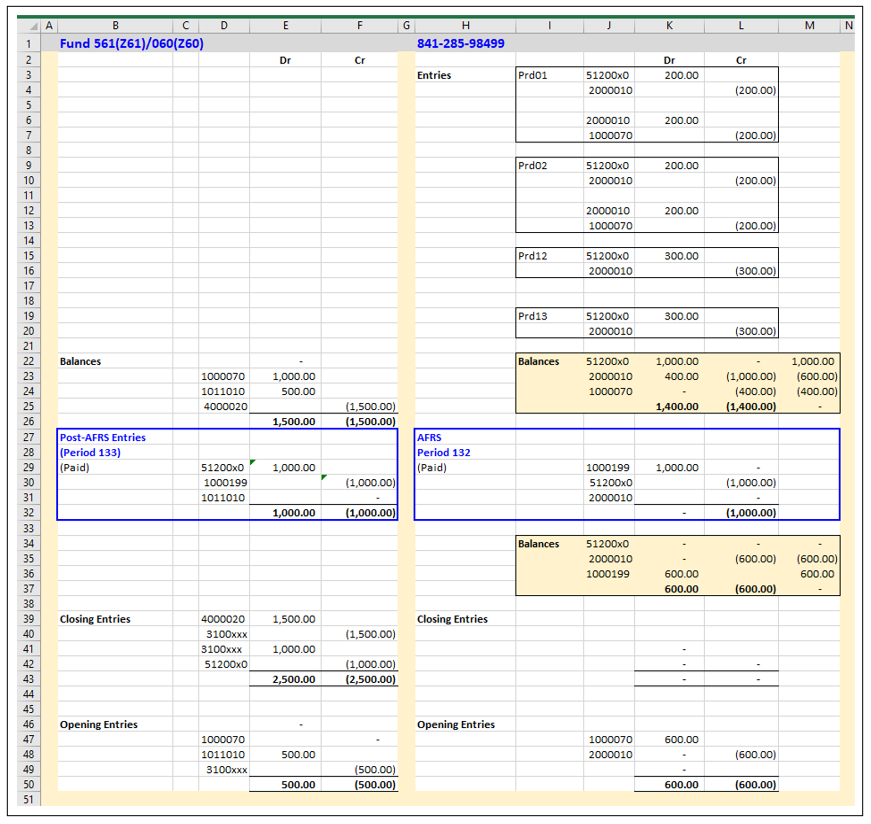

Year-End Entries (Prd 132 and 133)

Reverse (Cr) all expenditures (51200x0) in 790-285-98499 with an offset (Dr) to Internal Cash 1000199.

Record cash in bank (Cr 1000199) and expenditure (Dr 51200x0) in each PS_Fund/Appr Index (060/Z60, 561/Z61) ensuring the expenditures equals the cash revenue collected.

Fig. 3 Debit 060/Z60, 561/Z61 and Credit State Revenue Account 790-285-98499